Quick Summary

In a job market full of competition, it is absolutely necessary to know the entirety of your income package or CTC which stands for Cost to Company. One of the most important components of CTC is a variable pay which is the part of your income that is not fixed. Every month you get the same amount of your base salary but this part of the compensation varies. It is absolutely only linked to the performance, for example, if you achieve your personal targets, sales targets, or the company’s overall profit increases, then you get this pay.

The most common term for it is performance-linked pay. This flexible mechanism aims at inspiring and rewarding employees for providing extra contributions to the company that are beyond their normal duties. It is given as an addition to your fixed salary and not instead of your monthly check. There are several examples of variable pay from which a person can choose: annual bonuses, quarterly incentives, or sales commissions. The payout schedule varies from company to company.

It is very important for you to know the variable part of your CTC if you want to be able to calculate the total worth of a job offer accurately. It makes you distinguish between your guaranteed earnings and your potential, on-target earnings. If you know exactly how this pay is calculated and what you are supposed to do in order to get it, then you are at a very important position during negotiating a new role or discussing your compensation in a performance review.

Variable pay in CTC is a performance-based component of salary that varies depending on individual achievements or company success. Unlike fixed pay, it fluctuates based on targets met or goals achieved, commonly used in roles like sales or management to motivate and reward high performance.

Read More: Variable Pay in CTC

The term ‘current variable CTC’ means the portion of your salary that is performance-based or contingent on achieving specific goals. From the company’s perspective, variable pay in CTC serves several important purposes that contribute to both employee motivation and overall business growth.

When evaluating job offers, employees should carefully consider the importance of variable pay in CTC. While fixed pay provides financial stability, variable pay can significantly increase total earnings based on individual or company performance. During salary negotiations, it’s essential for employees to understand the variable CTC meaning, how the variable pay component is calculated, and what criteria need to be met to receive the maximum possible amount. A well-structured variable pay system can boost overall compensation and provide more earning opportunities.

CTC (Cost to Company) is the total cost incurred by an employer to hire and retain an employee. It includes both fixed pay and variable pay components.

This is the guaranteed portion of your salary that remains the same every month, regardless of your performance or company profits. It includes:

This component fluctuates based on the employee’s performance, the company’s performance, or other predefined criteria. It includes:

When understanding salary structures in India, it is important to be aware of the various components that make up a CTC. For official insights and regulations regarding compensation and employment standards, you can refer to the Ministry of Labour & Employment, Government of India, which provides comprehensive information on labor laws and salary norms.

When reviewing your CTC salary structure, it’s important to understand the distinction between fixed pay and variable pay, as both play crucial roles in determining your total compensation. Here’s a quick comparison of fixed vs variable pay:

| Feature | Fixed Pay | Variable Pay |

|---|---|---|

| Definition | Guaranteed salary that remains the same each month. | Fluctuates based on performance, business goals, or company profits. |

| Stability | Guaranteed, regardless of performance or company results. | Uncertain, dependent on individual or company performance. |

| Risk | Offers little risk as employees are guaranteed a fixed income. | Employees can be at risk of earning less if they don’t meet their targets or company earns losses. |

| Motivation | May not motivate employees to perform better. | Can motivate employees to work harder and achieve better results. |

| Budgeting | Allows employees to budget their expenses. | This can make it difficult for employees to budget. |

| Examples | Salary, annual wage, monthly stipend. | Commissions, bonuses, profit sharing, stock options. |

Read More: Negotiate Beyond Your Current CTC

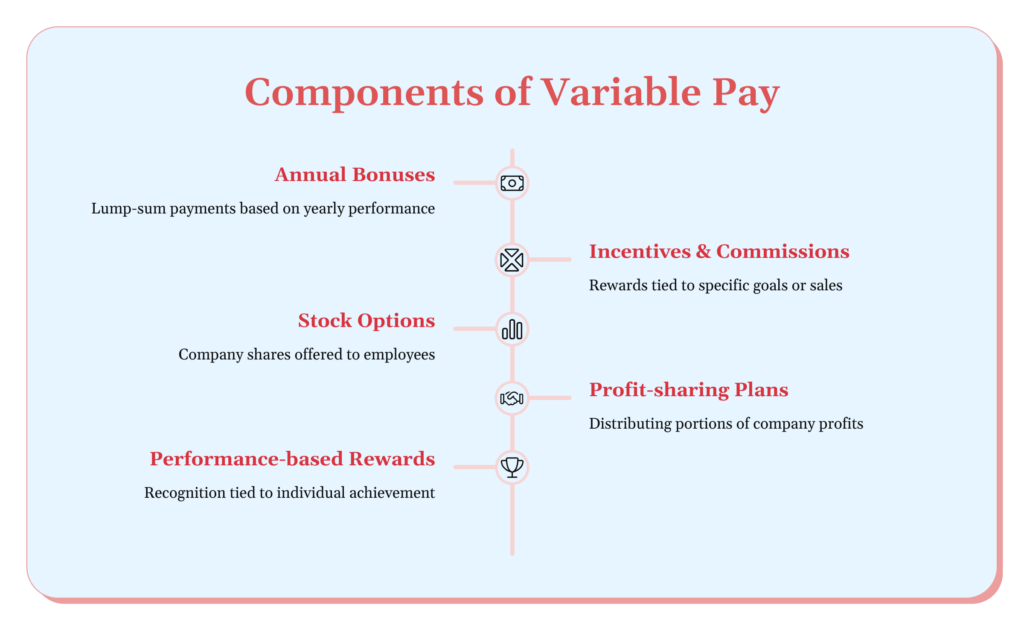

Variable pay in CTC can take many forms, each designed to reward employees for their individual contributions or the company’s overall performance. Here are a few common examples of variable pay:

Employees may receive an additional bonus if they exceed their performance targets for a specific period, such as a quarter or year. This is typically linked to measurable achievements like exceeding sales targets, increasing productivity, or meeting specific key performance indicators (KPIs).

Example: If a salesperson surpasses their quarterly sales target by 20%, they may receive a performance-based bonus as part of their variable pay in CTC.

In many sales roles, employees earn a commission based on the sales they generate. This type of performance-based pay directly links earnings to an employee’s ability to bring in revenue for the company.

Example: A salesperson receives 5% of the sales they generate in a month, which becomes part of their variable pay.

Some companies offer profit-sharing schemes where employees receive a portion of the company’s profits, often on a quarterly or annual basis. This serves as an incentive for employees to contribute to the company’s growth and success.

Example: At the end of the fiscal year, a company distributes 10% of its profits among its employees as a profit-sharing bonus.

Read More :- Understanding the Salary Slip

Understanding how to calculate variable pay in CTC is essential for employees to grasp how much they can earn beyond their fixed salary. Companies typically calculate variable pay based on specific performance criteria. Here’s a step-by-step explanation of how to calculate variable pay in CTC:

The first step in calculating variable pay is to clearly define the criteria that the employee needs to meet. These criteria could be based on individual performance, such as meeting sales targets, completing projects, or achieving specific business goals. In some cases, variable pay can also be linked to company-wide metrics like overall profits or revenue growth.

Once the criteria are defined, the employee’s performance is assessed. For example, if the target is to increase sales by 15%, the employee’s actual sales figures are compared to this target. If the employee surpasses the target, they qualify for a higher portion of their variable pay.

After assessing performance, the next step is to calculate the variable pay amount. Companies often set a percentage of the CTC as the variable pay. This percentage can increase if the employee exceeds the target or decrease if the target isn’t met.

Example Calculation:

If an employee’s CTC is ₹5,00,000 and their variable pay is set at 15% of CTC, the potential variable pay would be ₹75,000 if they meet the set performance criteria. If the employee exceeds their performance target, they might receive more than the calculated amount.

Recommended Read: How to Perform Basic Salary Calculation

Variable pay in CTC offers several advantages for both employees and employers, creating a win-win situation where both parties can benefit from a performance-driven work culture. Here’s a breakdown of the key benefits for each:

Variable pay in CTC is beneficial for both employees and employers because it creates a performance-driven work environment that rewards excellence and drives business success.

Negotiating variable pay during job interviews or salary discussions can have a significant impact on your overall compensation. Here are some useful tips for successfully negotiating variable pay in CTC:

Before accepting any job offer, it’s crucial to fully understand how the variable pay component of your CTC is calculated. Don’t hesitate to ask the employer for a detailed breakdown of the criteria that determine this part of your compensation. Is it linked to individual performance goals, team achievements, company-wide profits, or sales targets?

Knowing exactly what drives your variable pay will help you assess how realistic and attainable those targets are. It also allows you to estimate your actual take-home pay more accurately, instead of relying solely on the total CTC figure.

Additionally, clarify how frequently variable pay is disbursed-monthly, quarterly, annually and whether there are any conditions for eligibility. This kind of transparency not only prevents confusion later but also empowers you to make a well-informed decision about the job offer and your financial planning.

If you are confident in your abilities and believe you can exceed the set performance goals, you may want to negotiate for a higher percentage of variable pay. This is especially relevant in roles where performance is easily measurable, such as sales, project management, or leadership positions. Negotiating a higher percentage can significantly increase your overall earnings.

When you’re doing CTC salary negotiation, ensure you understand the conditions under which it is awarded and how it impacts your total compensation. It’s also helpful to understand whether the variable pay is discretionary or tied to performance targets.

For more information on negotiating variable pay and understanding CTC, visit “Learning’s Salary Negotiation Tips.”

In conclusion, understanding what variable pay in CTC is and how it impacts your overall compensation is essential for both employees and employers. Variable pay plays a critical role in determining your true earning potential, as it directly links performance and rewards. By clearly recognizing the difference between fixed pay (the guaranteed portion of your salary) and variable pay (the performance-linked component), employees can better evaluate job offers, negotiate effectively, and set realistic financial expectations. When assessing the total value of a salary package, it’s important to consider both fixed and variable components together to get a complete picture of your compensation structure.

For employees, variable pay offers the potential to earn more based on performance, which can serve as a powerful motivator for personal and professional growth. For employers, it aligns employee performance with company goals, fostering a high-performance culture that drives business success.

Evaluate numerous career choices to choose the right career path for yourself. Dive into our Guide on Career Advice.

Variable pay can be beneficial as it incentivises performance, aligns employee goals with company objectives, and can attract top talent. However, it may also lead to income instability, increased pressure on employees, and potential inequities if not managed properly.

Yes, variable pay is included in the Cost to Company (CTC). It forms part of the overall compensation package, alongside fixed salary and benefits, reflecting the total cost to the employer.

Variable pay is usually a percentage of the basic salary or linked to performance targets and company profits. It rewards employees based on achievements, ensuring incentives align with business success and individual contributions to the organization.

Variable pay in TCS CTC refers to a portion of the total compensation that is performance-based and can fluctuate based on individual or company performance, rather than being a fixed salary.

Current variable CTC refers to the performance-based part of your total salary at present. It includes bonuses and incentives, which depend on individual performance and business conditions. Unlike fixed salary, it can change based on targets achieved and company profitability.

In a Cost to Company (CTC) structure, 10% variable refers to a portion of the total compensation that is contingent on performance metrics or targets. This amount can fluctuate based on individual or company performance, such as sales targets or project completions, rather than being a fixed salary component.

Variable pay is not guaranteed; it depends on performance metrics, company results, or individual achievements.

Variable pay is typically calculated as a percentage of the total CTC:

Variable Pay=Total CTC×Variable Pay Percentage

For instance, with a CTC of ₹12,00,000 and a 15% variable pay, the calculation would be:

Variable Pay=₹12,00,000×15%=₹1,80,000

Authored by, Mansi Rawat

Career Guidance Expert

Mansi crafts content that makes learning engaging and accessible. For her, writing is more than just a profession—it’s a way to transform complex ideas into meaningful, relatable stories. She has written extensively on topics such as education, online teaching tools, and productivity. Whether she’s reading, observing, or striking up a conversation while waiting in line, she’s constantly discovering new narratives hidden in everyday moments.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.