Quick Summary

- A salary breakup structure is the breakdown of an employee’s total pay package.

- It includes basic salary, dearness allowance, HRA, provident fund and some other components.

- CTC means total cost incurred by the employer for an employee whereas in-hand salary is the amount that an employee receives.

Table of Contents

A salary breakup structure outlines the various components that make up an employee’s total compensation package. This structure helps employees understand how their salary is divided and it can include basic salary, allowances, benefits, and deductions.

Every month, you wait for your salary to get credited. But do you understand the nuances of the salary breakup structure? Did you know that your CTC is not equal to your in-hand salary? Well, it’s time to pull back the curtain and understand the components of your salary.

In this blog, you will learn in detail about your salary breakup. Your CTC (cost-to-company) includes Basic Salary, HRA, PF, Special allowances, and many other components. Read on to find out more about CTC and salary structure.

What is a Salary Breakup?

A salary breakup is a detailed description of the components that make up an employee’s total salary package. An employer outlines the various allowances, benefits, and deductions included in an employee’s pay. It is usually the most significant component of the salary.

Salary breakup is important for both employees and employers. Employees need to understand their salary breakup format so they know how much they earn and what deductions are being made from their salary. Employees need to understand their salary breakup to comply with government regulations and budget for their employee costs.

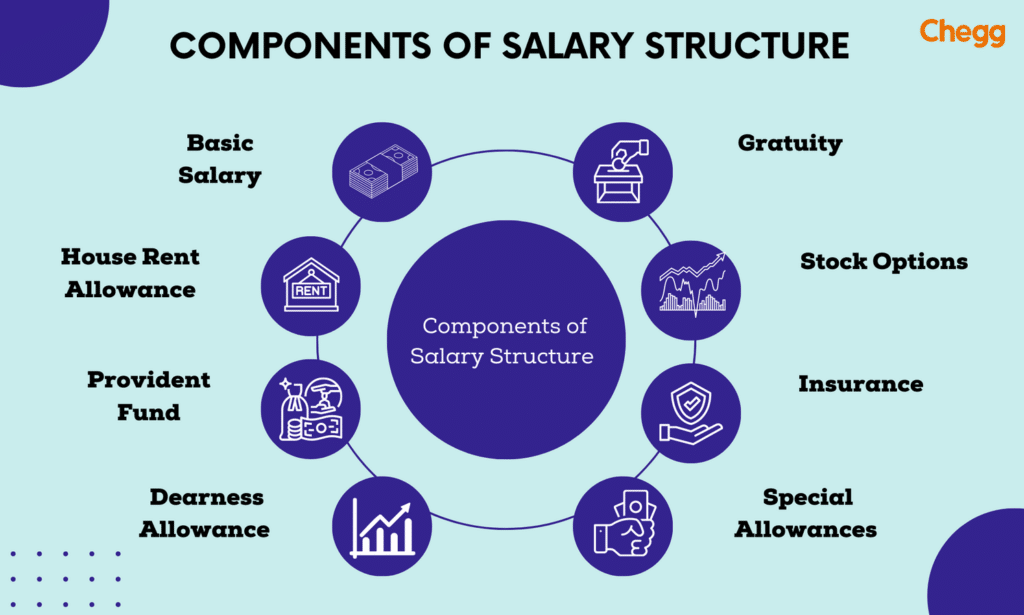

Components of Salary Breakup Structure

A salary breakup structure typically includes the following components:

- Basic Salary: The fixed component of an employee’s salary typically constitutes 40-60% of the employee’s CTC, including the gross and net salary.

- Dearness Allowance (DA): Employees get this allowance to cover the cost of living. It is usually a percentage of their basic salary.

- House Rent Allowance (HRA): HRA is paid to employees to cover the cost of renting a house which varies based on the city of employment.

- Conveyance Allowance: The company pays this allowance to employees to cover the cost of commuting to work. It is tax-free up to a certain limit.

- Medical Allowance: This allowance is paid to employees to cover medical expenses. is tax-free up to a certain limit.

- Special Allowance: Employees receive an allowance to cover expenses not included in other allowances. It is usually a fixed amount and is fully taxable.

- Employee Provident Fund (PF): The employer deducts around 12% of the employee’s basic salary and contributes it to the Employee Provident Fund. An employee can withdraw this at the time of retirement as a retirement benefit.

- Employee State Insurance (ESI): This social security scheme provides medical and other benefits to employees as per the Employees’ State Insurance Act of 1948. It is deducted from the employee’s salary and contributed to the ESI fund.

- Gratuity: A gratuity is a payment an employer makes to an employee as a token of appreciation for their services. To be eligible for gratuity, an employee must have completed at least five years of continuous service with the company, according to the Payment of Gratuity Act.

The above components may vary depending on the company’s policies. It can also depend on the employee’s designation, industry, location, and experience.

Salary Breakup Calculation Example

Given below is a simple salary breakup format with percentage used in India:

| Component | Description | Percentage |

| Basic Salary | The fixed salary amount forms the base of the salary structure. | 40-60% |

| House Rent Allowance (HRA) | An allowance to cover the cost of rented accommodation. | 40-50% |

| Conveyance Allowance | An allowance to cover travel expenses related to work. | 5% |

| Medical Allowance | An allowance is given to cover medical expenses. | 5% |

| Special Allowance | The specific allowances paid by the company and it varies depending on the company’s policies and the employee’s position. | 10-30% |

| Employee Provident Fund (EPF) | The employer matches the employee’s deduction towards retirement fund by contributing an equal amount. | 12% |

Note: The values given in the table are just for illustration purposes.

Related Read: Understanding the Salary Slip Breakup

Difference between CTC and In-hand Salary

CTC (Cost-to-Company) and In-hand salary describe an employee’s salary package in two different ways. However, there is a key difference between the two. CTC refers to the total cost incurred by the employer for an employee whereas In-hand salary refers to the amount that the employee takes home. This is after all deductions.

CTC includes all components of an employee’s salary package. This includes basic salary and allowances. It also includes benefits like health insurance, provident fund contributions, and gratuity. It also includes employer contributions towards taxes like TDS (Tax Deducted at Source) and ESI (Employee State Insurance).

In contrast, in-hand salary is the actual amount an employee receives after all deductions. This includes income and professional taxes along with provident fund contributions. This amount is usually lower than the CTC. It does not include any employer contributions toward benefits and taxes. The formula to calculate in-hand salary is

In-hand Salary = Gross Salary – Total Deductions(EPF+ESI+Gratuity+TDS+Professional Tax)

Factors Affecting Salary Breakup Structure

The salary breakup structure can vary greatly depending on a range of factors. Mainly, the key factors that can influence the salary breakup structure include:

- Industry and sector: Different industries and sectors have their own norms and standards when it comes to salary structures. For example, the salary breakup for IT professionals may differ from that of a sales executive.

- Company policies: Each company has its own policies and practices for salary structures. The company’s size, financial performance, and culture can influence this.

- Employee experience and qualifications: Employees’ experience and qualifications can also affect the salary structure. Companies may offer higher salaries to more experienced and highly qualified candidates.

- Job role and responsibilities: The salary structure may also depend on the job role and responsibilities of the employee. For example, a manager or team leader may have a higher salary breakup than a junior-level employee.

Understanding these factors can help employees negotiate better salary packages. They can also make informed decisions about job offers. Actual salary structures may vary depending on various factors.

The Importance of Understanding Salary Breakup and CTC

In today’s job market, it is essential to understand what CTC is. The CTC breakup provides a detailed breakdown of the different components. This constitutes the salary, while the CTC includes all the company’s expenses for hiring an employee. The in-hand salary is the amount that an employee receives after deductions. Several factors can impact the salary breakup structure. This includes industry, location, company policies, employee experience, job role, and negotiation.

By understanding these factors, employees can manage their finances better and plan for the future. Negotiating effectively can help employees achieve their career goals and attain financial stability. Therefore, employees must understand the salary breakup and CTC. This helps them make informed decisions when it comes to their careers.

The higher your CTC, the more you earn. Learn how to negotiate beyond your current CTC in a job interview!

Frequently Asked Questions (FAQs)

How to calculate breakup of salary?

In-hand Salary = Gross Salary – Total Deductions (EPF+ESI+Gratuity+TDS+Professional Tax) is the formula to calculate breakup of salary.

What is salary structure format?

A salary structure format typically includes base pay, allowances, bonuses, deductions, and benefits, outlined clearly for each position within an organization.

The formula for salary structure format for an employee would be: CTC = Gross Salary + EPF + Health Insurance.

What is the CTC for 35,000 salary?

The CTC for 35,000 salary monthly would be around ₹4,40,160. The formula that can be used is

CTC = Gross Salary + EPF + Health Insurance.

What are the components of salary breakup?

The components of salary breakup may include basic salary, allowances (such as house rent, travel, medical, and special allowances), and bonuses. It can also include provident fund contributions, gratuity, deductions (such as taxes, insurance premiums, and loan repayments), and other benefits (such as stock options or employee discounts). The exact components may vary depending on the employer’s policies. It also depends on the employee’s position and tenure.

What is CTC and in-hand salary?

CTC (Cost to Company) is the total amount an employer spends on an employee. This includes various benefits and allowances. The in-hand salary is the actual amount an employee receives in their bank account after all deductions and taxes have been applied. In-hand salary is usually lower than the CTC. This is due to deductions such as taxes, provident fund contributions, and insurance premiums.

To read more related articles, click here.

Got a question on this topic?