Quick Summary

Understanding what is fixed cost in business and what is fixed cost in economics is crucial for financial management. The fixed cost meaning refers to expenses that do not change with production or sales levels. Common fixed cost examples include rent, insurance, and salaries costs that remain stable even when output varies. In contrast, variable costs examples like raw materials and utilities rise and fall with production. Knowing the difference between fixed and variable costs examples helps businesses create accurate budgets, improve profitability, and maintain stability.

By learning what is fixed cost and variable cost, and applying the fixed cost formula, companies can calculate overheads, set smarter pricing strategies, and optimize margins. This guide explains not only what is fixed cost but also what is variable cost, offering clarity on both concepts with practical insights for business success in 2025.

What is Fixed Cost? Fixed cost refers to the expenses a business incurs that do not change regardless of the level of production or sales. These costs remain constant whether a company produces 1 unit or 10,000 units.

For example:

These expenses do not fluctuate with the company’s production or sales volumes.

In simple terms, fixed costs are the predictable, steady expenses that businesses must pay, no matter how much they produce or sell.

Understanding what is fixed cost is essential for managing business finances effectively. Fixed costs are expenses that do not change regardless of how much a company produces or sells in the short term. These costs are a crucial part of business operations and play a key role in financial planning.

Fixed costs remain the same even if there is a significant change in production levels. Whether a company manufactures 100 units or 1,000 units, these expenses typically stay unchanged in the short run. For example, rent for office space or salaries of permanent staff will not fluctuate based on output.

A defining feature of fixed costs is that they are independent of how much is produced or sold. Even if the production output drops to zero, businesses must still bear these costs. For instance, equipment maintenance contracts need payment regardless of production activity.

While fixed costs do not change in the short term, they can be subject to revisions over time. Rent agreements, for example, may be renegotiated annually, leading to an increase or decrease. However, within the agreed period, these costs typically remain stable.

Fixed costs often represent critical expenses that allow a business to function smoothly. Examples include utilities, insurance, and salaries for administrative staff. These costs form the foundation of operational continuity, irrespective of production levels.

One of the benefits of fixed costs is their predictability. Businesses can budget these expenses accurately, which aids in financial planning and forecasting. Knowing what is fixed cost helps companies assess their breakeven point and make better operational decisions.

By understanding the characteristics of fixed costs, businesses can better manage their resources, optimize spending, and achieve long-term growth while maintaining essential operations.

Read More:

To fully understand what is fixed cost, it helps to look at fixed cost examples. Fixed costs are those expenses that remain constant, regardless of how much a business produces or sells. These costs are unavoidable and necessary for maintaining the basic operations of any company.

A business pays rent for its office or manufacturing space regardless of the level of activity happening inside. Even if the office is temporarily closed or production slows down, the rent remains unchanged. This predictable monthly or yearly payment makes rent a classic example of a fixed cost.

Salaries paid to full-time staff are another common fixed cost. These employees receive a set amount each month, no matter how many products are manufactured or sold. For instance, the salary of an HR manager will stay the same, even if the company experiences a dip in sales.

Businesses often purchase insurance policies to protect against potential risks such as theft, accidents, or natural disasters. The premiums for these insurance policies are fixed and must be paid regularly, regardless of the company’s production levels or profitability.

Depreciation is the gradual reduction in the value of assets such as machinery, vehicles, and office equipment over time. Although depreciation is a non-cash expense, it is treated as a fixed cost because it remains consistent and predictable throughout the asset’s lifespan.

Utility bills, such as electricity and water, often have fixed basic charges that must be paid regardless of consumption. Even if the business uses minimal electricity or shuts down temporarily, these minimum charges still apply.

By understanding these examples, it becomes clear what is fixed cost and how these expenses impact business finances. Properly managing fixed costs allows companies to predict their financial obligations and make informed decisions to achieve profitability.

What is fixed cost and how to calculate it is essential for managing business expenses and planning budgets effectively. Fixed costs are the expenses that do not change regardless of the production level or sales volume of a business. Follow these simple steps to calculate fixed costs accurately:

Start by identifying all the expenses your business incurs within a specific period (monthly, quarterly, or yearly). These expenses typically fall under categories like rent, salaries, insurance, raw materials, and utility bills.

Once you’ve listed your expenses, classify them into two categories:

For example:

Read More: What Is Variable Pay in CTC: Do Incentives Matter?

Now, sum up all the expenses identified as fixed. This total represents your business’s fixed cost.

Example Calculation:

Let’s say the following are your business expenses for a month:

The total fixed cost would be:

₹15,000 + ₹5,000 + ₹25,000 = ₹45,000

Another way to calculate fixed costs is by using the formula:

Fixed Cost = Total Cost − Total Variable Cost

Example Calculation Using the Formula:

Suppose a company’s total cost for a month is ₹80,000, and the total variable cost is ₹35,000.To calculate the fixed cost:

Fixed Cost = 80,000 − 35,000

Fixed Cost = ₹45,000

This means the fixed cost for this business is ₹45,000.

By understanding what is fixed cost and knowing how to calculate it, businesses can better predict financial obligations, set pricing strategies, and manage overall profitability more effectively.

It is important to understand the difference between fixed costs and variable costs.

| Aspect | Fixed Cost | Variable Cost |

|---|---|---|

| Definition | Costs that do not change with production levels | Costs that change with production levels |

| Examples | Rent, salaries, insurance | Raw materials, packaging, shipping |

| Dependence on Output | No | Yes |

| Time Stability | Stable over time | Fluctuates |

Example for Clarity:

Fixed costs are expenses that remain constant regardless of production levels or sales volume. They play a significant role in business operations and decision-making processes. Let’s explore why they are important:

Fixed costs provide a stable foundation for creating accurate budgets. Since these expenses remain unchanged over a specific period, businesses can forecast their financial obligations and allocate funds effectively.

Example:

A company renting an office space for ₹50,000 per month knows this amount won’t change regardless of production. This predictability allows them to plan other expenses more accurately.

When setting prices for products or services, businesses must ensure that both fixed and variable costs are covered to maintain profitability.

Why it Matters:

If a business doesn’t account for fixed costs when pricing its products, it may suffer financial losses even if sales volumes are high.

Example:

If manufacturing a product costs ₹500 in variable expenses and the business has a fixed cost of ₹1,00,000, the product pricing must be set high enough to recover these fixed expenses over time.

Knowing what is fixed cost helps businesses calculate their break-even point the point where total revenue equals total costs, including both fixed and variable expenses.

Why it Matters:

This analysis helps determine how much a company needs to sell to start making profits.

Example:

If a company incurs ₹2,00,000 in fixed costs, it must generate sales that cover this amount before any profit is realized.

Effective management of fixed costs can help ensure a business remains financially stable, even during periods of low sales.

Why it Matters:

High fixed costs can strain a business if revenue fluctuates. Businesses with controlled fixed costs are better equipped to handle market uncertainties.

Example:

During an economic downturn, a company with lower fixed costs may survive better than one with high fixed obligations.

By managing fixed costs businesses can maintain better control over their finances, set competitive prices, and achieve long-term financial stability.

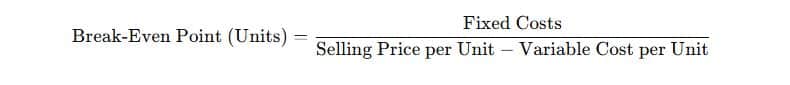

The break-even point is when a company’s revenue equals its total expenses, resulting in no profit and no loss. It helps businesses understand how many units they need to sell to start generating profits.

The formula for calculating the break-even point is:

Break-Even Point (Units) = ( Fixed Costs / Selling Price per Unit − Variable Cost per Unit )

Let’s break it down step by step for better understanding:

200 − 100 = 100

This means each unit sold contributes ₹100 toward covering fixed costs.

50,000 / 100 = 500

The business must sell 500 units to break even.

Mastering break-even analysis, businesses gain a valuable tool for managing expenses and achieving profitability.

Understanding Operating Leverage

Operating leverage is an important financial concept that helps businesses understand how fixed and variable costs impact their profitability. It measures how efficiently a company can increase profits by producing and selling more units.

When a company has high operating leverage, it means that a large portion of its costs are fixed. This allows it to generate more profit per additional unit sold. On the other hand, low operating leverage means that most costs are variable, making it harder to boost profits significantly with higher sales.

Operating leverage can be calculated using the formula:

Operating Leverage = Q×(P−V)(Q×(P−V))−FOperating \, Leverage = \frac{Q \times (P – V)}{(Q \times (P – V)) – F}

Where:

Understanding operating leverage is essential for businesses looking to optimize costs, maximize profits, and stay competitive in the market.

Understanding what is fixed cost isn’t just for textbooks it affects our daily lives! Let’s explore how fixed costs work in real-world Indian scenarios, from your home to local businesses

Imagine your family’s monthly budget:

Why it matters: Fixed costs help families plan savings. For example, if your parents know rent is ₹18,000, they’ll set aside that money first.

Fun Fact: Your monthly pocket money isn’t a fixed cost it’s a variable cost because parents might reduce it if you forget chores!

Application: The owner knows he must earn at least ₹27,000/month (rent + salary) just to cover fixed costs. Only after that can he make a profit

Challenge: During holidays, orders drop, but fixed costs stay the same. The owner might offer discounts to attract customers and cover these costs.

Your school has fixed costs too!

What is fixed cost’s role here? Schools must collect fees to cover these expenses, even during summer breaks.

Indian farmers face fixed costs like:

Problem: If crops fail due to droughts, farmers still pay these fixed costs. This is why farming can be risky.

Pro Tip: Fixed costs are like your phone’s monthly plan predictable but unavoidable. Plan for them wisely!

Now you know what is fixed cost and how it applies to real life! Whether it’s your home Wi-Fi bill or a farmer’s tractor loan, fixed costs are everywhere. By understanding them, you can make smarter money decisions just like a pro!

Read More:

Now that you understand what is fixed cost, let’s learn how to manage these expenses smartly. Whether you’re a student, a family, or a business owner, these tips will help you save money and avoid stress!

Fixed costs like rent or internet bills can sometimes be reduced with a little effort.

Pro Tip: Long-term contracts (like 2-year internet plans) often have lower monthly rates than short-term ones.

Replace expensive fixed costs with cheaper alternatives.

Remember: Always calculate total savings before switching.

Split fixed costs to reduce your burden.

Bonus Idea: Use co-working spaces to avoid high office rents.

Write down all fixed costs in a simple table. This helps you:

Example for Families:

| Fixed Cost | Amount (₹) |

|---|---|

| Rent | 15,000 |

| School Bus Fees | 1,500 |

| Electricity Bill | 2,000 |

Pro Tip: Use free apps like Moneycontrol or Excel to track expenses.

Fixed costs don’t stop during tough times. Save money in advance to cover them.

Golden Rule: Save at least 10% of your income for fixed costs.

Some fixed costs are necessary for safety or quality. For example:

Managing what is fixed cost is like planning your school timetable know what’s coming, prepare for it, and avoid last-minute panic! By negotiating, sharing, and tracking expenses, you can control fixed costs instead of letting them control you.

Action Step: List your fixed costs today and see where you can save!

In conclusion, understanding what is fixed cost in business and what is fixed cost in economics is vital for long-term success. By learning the fixed cost meaning, applying the fixed cost formula, and recognizing common fixed cost examples like rent and salaries, businesses can budget more accurately. Comparing fixed and variable costs examples also highlights the difference between what is fixed cost and variable cost in real-world scenarios. When combined with knowledge of variable costs examples and what is variable cost, this clarity supports stronger pricing strategies, profitability, and financial stability. Managing these costs effectively is the foundation for business growth in 2025 and beyond.

Innovative, low-investment ideas for the hidden entrepreneur in you! Explore our guide on Business Ideas.

Recommended Read:

A fixed cost is an expense that does not change when sales or production volumes increase or decrease.

Variable costs are expenses that go up and down in line with business activity. The busier you are, the higher they go. They’re the opposite of fixed costs. Many variable costs, such as inventory and freight, go up in line with the number of sales a business is making.

Fixed costs are expenses that stay the same no matter how much activity a business is doing. They’re the opposite of variable costs. Fixed costs have to be paid even if a business doesn’t do any trade for the day. They tend to include regular recurring costs like leases, wages and insurance.

Fixed price is a set price that does not change, while cost price is the amount it costs to produce or purchase an item.

To calculate fixed costs, you can sum up all your fixed expenses (like rent or salaries) directly, or you can use the formula: Fixed Cost = Total Expenses – (Variable Cost Per Unit × Number of Units Produced).

Fixed cost is an expense that stays the same regardless of production levels, like rent. Variable cost changes with production levels, like raw materials.

Fixed costs: rent, salaries. Variable costs: raw materials, labor.

Business utility expenses include electricity, water, gas, internet, and phone services. They are generally semi-variable costs, partly fixe,d but can fluctuate depending on usage, making them not entirely fixed in nature.

Fixed costs stay constant regardless of production levels (e.g., rent), while variable costs fluctuate with output (e.g., materials). Understanding both helps in budgeting, pricing, and improving profit margins effectively.

Variable costs change based on production levels, including expenses like raw materials, direct labour, and shipping. These costs rise or fall with the amount of goods or services a business produces or sells.

The fixed cost formula is: Fixed Costs = Total Costs − Variable Costs. It calculates expenses that stay constant regardless of production, such as rent, salaries, and insurance, helping businesses manage budgets and pricing effectively.

Authored by, Samiksha Samra

Digital Content Writer

Samiksha is a writer with a passion for sharing ideas and a knack for detail. She loves turning concepts into meaningful, engaging content. With a strong background in research and content strategy, she crafts clear, easy-to-understand narratives that resonate with readers. Her curiosity drives her to explore new subjects, ensuring every piece she creates is both insightful and impactful.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.