Got a question on this topic?

Quick Summary

Table of Contents

Authored by, Amay Mathur | Senior Editor

Amay Mathur is a business news reporter at Chegg.com. He previously worked for PCMag, Business Insider, The Messenger, and ZDNET as a reporter and copyeditor. His areas of coverage encompass tech, business, strategy, finance, and even space. He is a Columbia University graduate.

CFA vs CA is a choice that every commerce student must make once in their lifetime. The decision between CFA or CA is crucial, as it can significantly impact one’s career path. With over 1 lakh students applying for the CFA exam and over 1.2 lakh for the CA exam each year, both are in-demand career options. But the question remains: what is the difference between CFA and CA, and which one should you choose?

Don’t worry after reading the article you will be able to choose the best course for yourself. So, let’s get started and know all about CA and CFA in detail.

Refer the following articles for recent updates of CA and CFA:

|

Chartered Financial Analyst (CFA) |

Chartered Accountant (CA) |

|

Chartered Financial Analyst is conducted by the CFA institute globally. The CFA course mainly consists of investment management and wealth management analysis. The CFA program focuses primarily on knowledge and expertise applicable to the investment and management profession. |

Chartered Accountancy (CA) is conducted by the Institute of Chartered Accountants of India (ICAI). A chartered accountant, also known as Certified Public Accountant, is a professional accountant working with various accountancy firms or companies related to the same. |

Also Read:

According to the respective CA and CFA Institutes, the following is the minimum required time to acquire the CFA and CA designation.

|

Chartered Financial Analyst (CFA) |

Chartered Accountant (CA) |

|

1. Graduation in any discipline from any recognized institute. 2. Four years, approximately, to complete the program. 3. Six months of preparation for each exam. 4. Over 300+ hours of study time. |

For Non-Graduates: 1. Candidates must clear the 10+2 examination from a recognized board/institute. 2. A minimum aggregate of 50% in class 12 examinations. 3. No age restrictions. For Graduates: 1. A minimum aggregate of 50% for commerce graduates. 2. A minimum aggregate of 60% for non-commerce graduates. |

Once a person clears the CFA exam or CA exam, they become eligible to apply for jobs. If you clear your exams with higher marks, then you can even get offers from the best companies for CA and CFA. Some of the top hiring companies for CA and CFA candidates are:

|

Chartered Financial Analyst (CFA) |

Chartered Accountant (CA) |

|

1. JPMorgan Chase 2. Royal Bank of Canada 3. Morgan Stanley Wealth Management 4. BofA Securities 5. HSBC Holdings 6. Wells Fargo and Company 7. Pricewaterhouse Coopers 8. BlackRock 9. TD Bank Financial Group |

1. Deloitte India 2. Ernst & Young India 3. Price Waterhouse Coopers India – PwC India 4. KPMG India 5. Luthra & Luthra India 6. Lodha & Co. 7. Grant Thornton International |

Give a read to Salary and Top Recruiters for CA.

Both CA and CFA play a crucial part in their company, there are certain tasks and responsibilities which can only be done by them. These are the responsibilities which CA or CFA has to fulfil.

|

Chartered Financial Analyst (CFA) |

Chartered Accountant (CA) |

|

1. Credit analysis. 2. Coming up with investment strategies and opportunities. 3. Investment banking. 4. Helping and consulting companies with stocks, financial assistance, and money-making investment opportunities. 5. Research and track the financial position of the company or an individual. |

1. Head of the accounting department and overlook the duties for the same. 2. Creating and maintaining the accounting systems and processes. 3. Coordinate financial statements. 4. Prepare monthly financial reports. 5. Review and release online banking payments. 6. Ensure compliance with state revenue service. 7. Provide ongoing accounting and reporting support. 8. Manage the full financial process. 9. Prepare an expense budget report. 10. Financing reporting and auditing |

|

Chartered Financial Analyst (CFA) |

Chartered Accountant (CA) |

||

|

Career Prospect |

Average Salary (in INR) |

Career Prospect |

Average Salary (in INR) |

|

Research Analyst |

3.5 LPA |

Tax Auditor |

5 LPA |

|

Corporate Financial Analyst |

7.5 LPA |

Internal Auditor |

3 LPA |

|

Auditor |

2.7 LPA |

Accountant |

2.5 LPA |

|

Consultant |

11 LPA |

Forensic Auditor |

7 LPA |

|

Risk Manager |

9.9 LPA |

Management Accountant |

9 LPA |

|

Relationship Manager |

3.5 LPA |

Investment Banker |

4 LPA |

|

Credit Analyst |

5 LPA |

Management Consultant |

22 LPA |

|

Portfolio Manager |

7 LPA |

Government Accounting |

4 LPA |

Salary Source: AmbitionBox, Glassdoor

Both certifications have various classifications that are essential to differentiate. CFA must be a viable option for you if you want to acquire more knowledge and expertise in training in the financial or investment sectors as an analyst.

On the other hand, if you want to better your number-crunching skills, accounting, auditing, and taxation, you must consider CA as your career option. That makes choosing a little simpler to choose between CFA vs CA.

Now, let’s factor in and compare all the difference between CFA and CA at a glance.

|

Components |

Chartered Financial Analyst (CFA) |

Chartered Accountant (CA) |

|

Organization |

Chartered Financial Analyst Institute (CFAI) |

Institute of Chartered Accountants in India (ICAI) |

|

Academic Qualification Required |

10+2 Examination |

Graduation |

|

Duration of the course |

Divided into three levels, CFA requires a minimum of 4 years of work experience. |

Divided into three levels, CA requires a minimum of 3 years of work experience. |

|

Exam Type |

MCQ paper-based exam |

Subjective paper-based exam |

|

Pass Percentage (Overall) |

34.6% |

25.28% |

|

Core Area |

Finance |

Accounting, Taxation, Audit, Law, Finance |

|

Focus subjects |

|

|

|

Job Profiles |

|

|

|

Average Income |

Fresher: 6 Lakhs |

Fresher: 7 Lakhs |

|

Course Fees |

₹3-3.5 lakhs approx |

₹2-2.5 lakhs approx |

You can analyse your choice of CFA vs CA by keeping the shared information in mind.

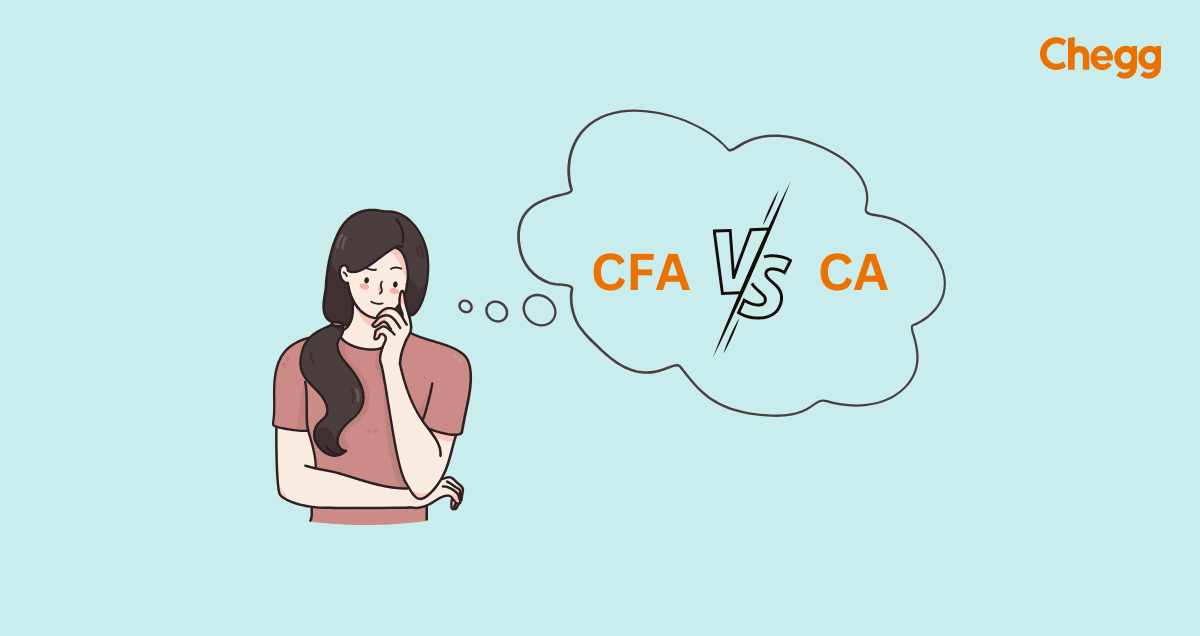

You might be confused about CFA vs CA, but what about a combination of both of these degrees? Having a CFA certification along with a CA certificate is also possible. Pursuing CFA after completing CA is considered a profitable combination in the finance domain and will make you stand out among others. This path will certainly open new avenues for you in financing.

Chartered Accountants can easily clear the CFA level 1 exam. That’s one of the advantages of doing CFA after CA, as the syllabus for CA course overlaps with the syllabus of the CFA level 1 exam and is almost similar. A combination of CA+CFA not only broadens your horizon but also helps you understand the financial and auditing field better.

Many CA aspirants even head towards CFA, as it increases their hiring potential and demand within high-end firms. Companies always prefer individuals with deeper knowledge and expertise in the financial domain. Hence, the CA+CFA combination can be considered suitable for acquiring better position and increases your chances of getting associated with top-tier global companies.

Do you know what you can earn while preparing for your CA or CFA exams. Yes, it is possible thanks to Chegg India. Chegg gives you the opportunity to become their Subject Matter Expert, and solve questions posted by students. With every correct answer not only, do you gain confidence in your knowledge but earn money too.

And Chegg is not only for Accounts students, anyone with expertise in any subject can go and register as Subject Matter Expert on Chegg. You just need to register yourself on the platform, go through a screening process and after verification you can start answering questions. There are numerous subjects like Accountancy, Economics, Statistics, Mathematics, Biology, Nursing, Earth Science and many more.

Choosing one from the best of the bests can be a puzzling task, in such situations comparing all the opportunities on various basis can help. Just like this piece where the comparison between CFA vs CA is done on a different basis.

If you are still confused then please re-read the information, and also do some more research. But in the end, it’s your call what you want to choose, and it is advised that you take your decision based on your passion, abilities and future goals. So, choose what’s right for you and All the Best for your Future.

Evaluate numerous career choices to choose the right career path for yourself. Dive in to our guide on Career Advice.

No, on the contrary, CA is considered much more difficult than CFA. CA requires more preparation, time and hard work to pass. With only a 0.5% passing percentage throughout the world, CA is the toughest exam. And if you clear the CA exam you can easily pass CFA.

CFA vs CA who gets paid more, the answer to this question is CA. With an average salary package of 7- 10 lakhs per annum, CA gets paid more than CFA, who’s annual income lies between 6-8 lakhs per annum.

Yes, pursuing CFA after CA is positively worth it. Once you clear your CA exam you can start preparing to get CFA certification. And if you get the certification your employment demand will increase, and you can demand for higher and better salary package.

There are great career prospects for candidates who choose and get CFA certificate, one can pursue following careers:

1. Investment Banking

2. Portfolio Management

3. Equity Research

4. Credit Analyst

5. Chief Investment Officer

6. Commercial Banking

Yes, CFA is in demand in India, especially in finance, investment, and banking. Top firms like JP Morgan, Goldman Sachs, and Indian banks hire CFAs, offering salaries from ₹6-25 LPA based on experience.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.