Quick Summary

- Chartered Accountants are professionals who are qualified to perform accounting, auditing, and tax-related tasks.

- In India, an entry-level CA may earn ₹6-10 lakhs annually.

- MBA, CFA, Data Science, and Law are some of the top course options after CA.

Table of Contents

With over 3 lakh Chartered Accountants in India present, it can be said that CA is one of the most preferred career options among the youth of India. The Chartered Accountancy (CA) course is widely respected, and individuals considering their career choices often find themselves uncertain about whether to pursue CA as a full-time profession. When faced with this dilemma, individuals begin exploring career options after CA. Without further ado, let’s jump into a quick overview of career possibilities and courses available after completing CA.

There can be some great career options that you can pursue after completing your CA. Here you will get to know all about career options after CA and courses after CA that you can pursue to excel in your career.

Top Career Options after CA

There are various career options available after CA. The salary of CA may depend on your designation, work experience and company.

|

Career Options |

Skills Required |

Average Salary (in INR) |

|

Internal Audit

|

| |

|

Tax Audit

|

| |

|

Banking and Insurance

|

| |

|

Teach Accountancy

|

| |

|

Forensic Auditing

|

| |

|

Consultancy

|

| |

|

Civil Services

|

|

Based On Job Designation |

|

Investment Banking

|

| |

|

Writing and Authoring

|

| |

|

Financial Manager

|

| |

|

Risk Manager |

| |

|

Entrepreneur |

|

12 Terrific Career Opportunities After CA

1. Internal Auditing

When looking up career options to pursue after CA Internal Audit would show on top of the list. An internal auditor is a professional who performs an independent, objective assessment of an organization’s financial and operational systems.

If you choose this career in CA, then your primary role is to review and evaluate the effectiveness of the internal control systems in place, identify areas of potential risk or inefficiency, and make recommendations for improvement. You will work closely with management to ensure that the organization is complying with relevant laws, regulations, and industry standards.

Responsibilities

- Checking the financial statements and rules and regulations of the organization.

- Auditor also looks at administrative, legal, and executive functions as well.

- Developing and implementing audit plans and programs based on the organization’s objectives and priorities

- As auditor, you will evaluate the reliability and integrity of financial and operational information

- Communicating audit findings and recommendations to senior management and the board of directors

Read about the Complete Chartered Accountancy (CA) Course Guide.

2. Tax Auditing

Tax auditing is another answer to your question of what to do after CA. As a tax auditor, you will be responsible for examining and reviewing financial records and tax returns of individuals, businesses, and organizations to ensure that they comply with tax laws and regulations.

Your primary objective will be to identify any discrepancies or errors in financial reports, investigate potential fraud or other violations of tax laws, and calculate the correct amount of taxes owed. It is one of the best jobs after CA for people who love working with taxes, calculations and finding errors to correct.

Responsibilities

- Reviewing and analysing financial statements and records of the taxpayer to determine their tax liability.

- Conducting field examinations or audits to verify the accuracy of the taxpayer’s financial records and investigating potential tax fraud or other violations of tax laws.

- As a tax auditor, you will prepare detailed audit reports that outline findings, conclusions, and recommendations.

- Provide guidance and education to your clients on tax laws and regulations.

3. Banking and Insurance

Working in the banking and insurance sector is another one of the best career opportunities after CA. As a banker, you will be working in the banking industry, primarily in financial institutions such as banks, credit unions, and investment firms.

You will be providing financial services to individuals, businesses, and governments, including loans, savings accounts, investment advice, and money management. You will also help clients navigate complex financial products and services and advise them on making smart financial decisions. While working as a banker/insurance person you will get your answer to what to do after CA and will also answer the clients.

Responsibilities

- Analyse customer financial data to identify opportunities to cross-sell or upsell banking products.

- As banker/insurance advisor you need to build and maintain customer relationships by providing excellent customer service.

- Conduct financial assessments and credit checks on customers to determine their eligibility for loans or other financial products.

4. Accountancy Teacher

If you are searching for the answer to what to do after CA? Then becoming an accountancy teacher might be one of the good career options after CA. As an accountancy teacher, you can use your CA specialization to teach students the principles and practices of accounting.

You can also provide guidance and support to students to ensure they understand the subject matter and can apply their knowledge in practical situations. Effective accountancy teachers use a variety of teaching methods, such as lectures, group discussions, and case studies, to engage students and facilitate learning. This is the best way to make a career in CA and help the future CAs of the nation.

Responsibilities

- Deliver lectures and presentations on accounting topics to students and assign and grade homework, projects, and exams.

- Stay up to date with changes in accounting laws and practices, and incorporate new information into teaching materials.

- Create a positive and engaging learning environment that fosters student participation and collaboration.

- Mentor and advise students who are interested in pursuing careers in accounting or related fields.

- Participate in school-wide committees and initiatives to improve the overall educational experience for students.

5. Forensic Auditing

Forensic auditing is a specialized type of auditing that involves the investigation of financial and accounting records to identify fraud, embezzlement, or other financial misconduct. If you are confused about what to do after CA, forensic auditing is a great choice. As a forensic auditor, you will be using a variety of techniques, such as data analysis, interviews, and document review, to identify patterns and inconsistencies that may indicate fraudulent activity.

Forensic auditing is becoming increasingly important in today’s business world, as companies are facing mounting pressure to maintain transparent and ethical business practices. If you choose forensic auditing as one of the jobs after CA, you will be in a career of exciting challenges and growth.

Responsibilities

- As a forensic auditor, you will be responsible for conducting investigations into financial crimes and fraud.

- Forensic auditors review financial data and analyse accounting records to identify patterns or anomalies that may indicate fraudulent activity.

- As forensic auditors, you may need to advise clients on ways to prevent fraud and to improve their financial reporting and internal controls.

6. Consultancy

Going into the consultancy field is another of your answers to the question of what to do after CA. You can become a financial consultant and work to advise individuals, businesses, or organizations on various financial matters, including investment strategies, tax planning, retirement planning, and risk management.

You will be helping your clients achieve their financial goals by assessing their current financial situation, analysing market trends, and developing customized financial plans. Your goal will be to provide their clients with comprehensive financial advice and help them make informed decisions about their money.

Responsibilities

- When you choose consultancy jobs after CA, you’ll be responsible for assessing the financial needs of your clients and providing them with advice on investments, savings, retirement planning, and other financial matters.

- Analysing the financial data of your clients is another of your responsibilities so that you can check their credit score, assets and liabilities etc.

- Consultants also have to manage investment portfolios for clients, making decisions on buying and selling securities based on their analysis.

- Consultants also need to explain financial concepts and investment strategies to clients in a way that’s easy to understand.

7. Civil Services

Civil Services refer to the administrative branches of government responsible for implementing and enforcing policies and laws. If you are someone who would like to work in a government department and are still wondering which career options to choose after CA, then you should try civil services. Civil Services Officer you will be responsible for ensuring the smooth functioning of government and maintaining law and order.

Recruitment to these services is done through competitive exams, and candidates are selected based on merit and suitability for the role. And you will be working at the levels you get assigned by the government.

Responsibilities

- As a civil services officer, you are responsible for ensuring that services like healthcare and education are delivered efficiently and effectively and that they meet the needs of the citizens.

- You will work with law enforcement agencies to ensure that the community is safe and protected.

- Civil service officers work to ensure that government policies and programs are in line with environmental regulations and standards.

- You will be providing advice to political leaders on policy issues and helping to develop and implement policies that address the needs of the citizens.

8. Investment Banking

Investment banking is a type of financial service provided by banks and financial institutions to help companies and governments raise capital by issuing securities. These bankers act as intermediaries between issuers and investors, providing guidance and support throughout the capital-raising process. You can consider as one of the best jobs after CA in terms of success rate.

As an investment banker, you will typically work with large clients, such as corporations, government agencies, and institutional investors, and earn revenue through fees and commissions. The investment banking industry is highly competitive and requires specialized knowledge of financial markets, complex financial instruments, and regulatory frameworks. Working in this field is the perfect answer to your question of what to do after CA, as you will be applying all your CA knowledge here.

Responsibilities

- You will be working for raising capital, helping with IPOs, setting prices for financial instruments, etc.

- You will also assist clients with mergers and acquisitions by providing financial advice, valuations, and transaction structuring.

9. Writing and Authoring

Writing can be another answer to your what to do after the CA question. It is the act of putting words on paper or a screen to convey a message or tell a story. It can take various forms, including essays, articles, novels, poems, and scripts. Writing can be done for various purposes, such as to inform, persuade, entertain, or express oneself.

As an author, you can write articles, books and newsletters related to financial tips, knowledge and advice for people. And as your writings get popular you can make money by affiliate marketing, running ads and collaborating with brands. It is one of the great career options after CA that you can start even from your home.

Responsibilities

- As a financial writer, you must conduct extensive research to gather information on financial topics. You should be knowledgeable about financial markets, products, and trends.

- You must edit and proofread your work thoroughly to ensure that it is free of errors and inconsistencies. You should be familiar with standard grammar, punctuation, and style conventions.

- Financial writers must be able to work under tight deadlines and deliver high-quality content on time.

- You should have strong marketing skills and be able to create compelling headlines and descriptions that attract readers.

10. Financial Management

The answer to what to do after CA has a range of jobs in core finance and sub-specializations. Financial Management a core job role in finance is about investing company resources in a way that brings in the most returns. Financial Management also includes four other categories, Financing Decisions, Investment Decisions, Dividend Decisions, and Working Capital Decisions.

Among all other options in what to do after CA, this is a full-time position in the finance department in an organization. There is no need to pursue a separate certification or degree to work in Financial Management. All Chartered Accountants who work in the finance departments at companies can work in Financial Management.

This is one answer to what to do after CA that is not much different from what traditional companies do. A part of the duties of an average Chartered Accountant also matches with what the Financial Manager does. When employed Financial Managers are in control of the entire company’s budget.

Suggested Read: Is Finance a Good Career Path for 2023

Responsibilities

- As a financial manager, you would be developing and implementing financial strategies and policies to ensure the financial health and stability of the organization.

- You will be creating and managing budgets, forecasting financial performance, and analysing financial data to make better business decisions.

- It is the responsibility of a financial manager to communicate every finding on the financial information of a company with stakeholders, company seniors and other parties.

- You will be developing and implementing financial controls and processes to ensure the accuracy and integrity of financial data and identifying opportunities for process improvements.

11. Risk Management

Risk management is another job after pursuing a CA that you can consider positively. It is the process of identifying, assessing, and prioritizing potential risks and then taking steps to minimize or mitigate them. It involves analysing the likelihood and potential impact of risks, developing strategies to prevent or reduce the risks, and establishing a plan of action in case the risks do occur.

Risk management enables individuals or organizations to anticipate and respond to potential threats or challenges, thereby protecting themselves from financial losses. It is an essential part of any successful business or personal endeavour and involves a combination of careful planning, strategic decision-making, and ongoing monitoring and evaluation. This field is a good answer to your what to do after CA question, not only it’s an exciting career but profitable too.

Responsibilities

- As a risk manager, it is your task to identify potential risks that the organization may face. It will involve analysing past incidents, reviewing policies and procedures, and conducting risk assessments.

- You will also work on developing policies and procedures to reduce the likelihood of risks occurring, as well as developing contingency plans to minimize the impact if risks do occur.

- A risk manager needs to monitor the effectiveness of risk management strategies and make adjustments as necessary.

- It will be your responsibility to report on the organization’s risk management activities to senior management and other stakeholders.

12. Entrepreneur

Working for yourself is the best feeling, entrepreneurship is the venture that lets you have this feeling. So, if you are wondering what to do after CA, then you can become an entrepreneur in India. But yes, you must have some idea that can be sold as a product or service. Entrepreneurship is something that can lead to great success and with your financial knowledge as CA you can find it much easier to manage expenses and create a budget for the venture.

Responsibilities

- To hire responsible and dedicated employees and train them during the initial stage of a business venture.

- As an entrepreneur, you need to secure enough funds from multiple sources to start your business operations.

- Develop an overall business plan, from production to marketing and promotion of products or services offered by the business.

- You need to deal with legal aspects of the business, to make sure everything happens within rules and regulations.

Recommended Read:

10 Tips For Entrepreneurs to Become Successful

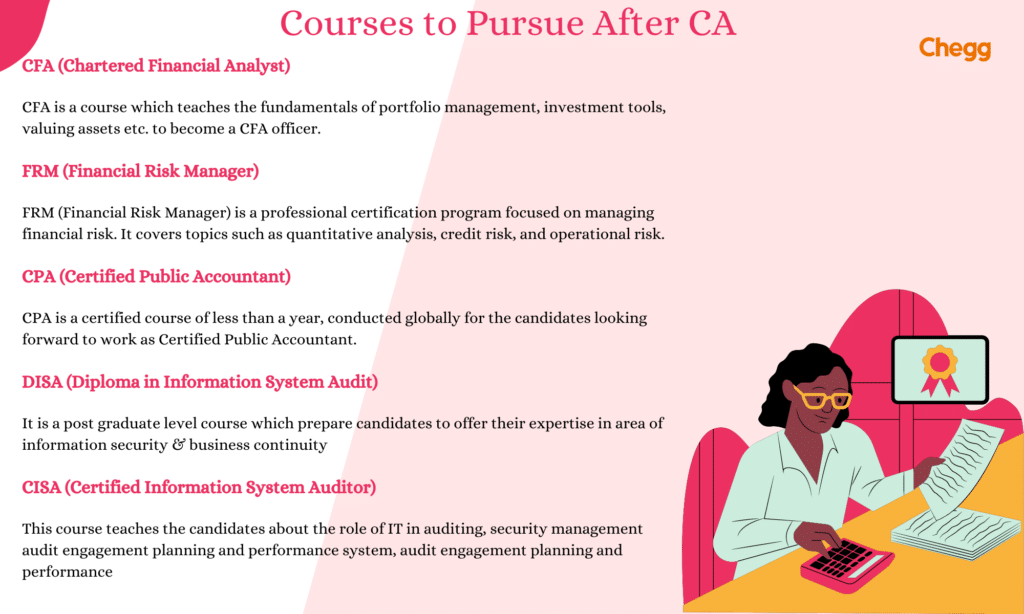

Best 5 After CA Courses to Pursue

If you are wondering what to do after CA, and want to gain more knowledge and excel greater success in your career then you can positively pursue the best course after CA. Here is the list of such courses that you can take up after completing CA.

| Course | Description | Course Fees |

| Chartered Financial Analyst | The CPA exam assesses candidates’ knowledge and skills in various areas of accounting and business. Most jurisdictions require candidates to have a bachelor’s degree from an accredited university or college. | INR 2 to 2.2 lakh |

| Financial Risk Manager | The FRM program is designed to enhance the skills and knowledge of risk management professionals. To enrol in the FRM program, candidates need a bachelor’s degree or equivalent work experience. | INR 1 to 2 lakh |

| Certified Public Accountant | The CPA exam assesses candidates knowledge and skills in various areas of accounting and business. Most jurisdictions require candidates to have a bachelor’s degree from an accredited university or college. | INR 3.5 to 3.6 lakh |

| DISA | The DISA program typically covers various aspects of information system auditing, including risk management, cybersecurity, IT governance, and compliance. Eligibility criteria may include having a background in information technology, information systems, or a related field. | INR 20,000 + 18% GST |

| CISA | The CISA exam assesses candidates in various domains related to information systems auditing, control, and security. To be eligible for the CISA exam, candidates typically need a minimum of five years of professional information systems auditing, control, or security work experience. | The cost of the CISA exam is $575 for an ISACA member and $760 for a non-member |

Make An Earning as A Chartered Accountant

Most people who pursue the Chartered Accountancy course aspire to work in the same designation, as a CA. There are other options to explore that are just as bright and stable. If you are still wondering what to do after CA, then re-read the article and you will find that there are so many career opportunities after CA.

Not, only career opportunities, but there are courses to do after CA too, doing these courses will open golden gates of opportunities. So, don’t wait and start your after-CA career journey.

Evaluate numerous career choices to choose the right career path for yourself. Dive into our guide on Career Advice.

Frequently Asked Questions

What should I do after I become a CA?

If you are also wondering what to do after CA, then don’t worry there are many career opportunities and higher education courses that you can go with some of the best career choices are:

1. Tax Auditor

2. Internal Auditor

3. Consulting

4. Risk Manager

5. Civil Services

Which job is best after CA?

If you have an interest in any career options after CA, and you pursue it with dedication, the right skills and hard work; then any job will become the best job for you. However, there are some of the best jobs after CA are:

1. Consultancy

2. Forensic Banking

3. Investment Banking

4. Financial Management

What is the next course after CA?

Thinking about what to do after CA, then you can pursue some good courses that can help you understand accounts more extremely and will also help you get better career opportunities. Some of the courses to do after CA are:

1. CFA

2. FRM

3. CPA

Which field in CA has the highest salary?

If you think about what to do after CA, then there are some of the highest-paying jobs in the CA field that pay more than 20 lakhs per annum. Some of them are:

1. CFO

2. Financial Manager

3. Account Executive

4. Financial Controller

Does CA have scope in the future?

Yes. There is always going to be an immense scope for Chartered Accountants in the future. CAs are trained experts in Accounting, Taxation, and Business Law. This makes them extremely valuable individuals for all sorts of organizations. Companies need a person to prepare and check financial documents, perform audits and also help with filing taxes.

To read more related articles, click here.

Got a question on this topic?