Quick Summary

- An emergency fund is a reserve of funds that you set aside for unexpected financial emergencies.

- The general rule of thumb is to keep aside around 3-6 months’ worth of essential expenses.

- Emergency funds must be kept in a safe and accessible place.

Table of Contents

Emergencies can happen to anyone, anytime, and having an emergency fund can be a lifesaver. Having emergency funds readily available can help you tackle emergencies such as unexpected medical expenses, a sudden job loss, or significant home repairs with ease.

To be ready for such unforeseen situations, one needs to understand the concept of emergency funds and how to set them up. Our article aims to provide clarity on the meaning of an emergency fund and its importance in your financial planning.

In this article, We will delve into the significance of emergency money and how to create an emergency fund. Let’s start by learning how to build an emergency fund to secure your financial future.

What Is An Emergency Fund?

An emergency fund is a reserve of funds that you set aside for unexpected financial emergencies. It is an essential part of any sound financial plan, as it provides a buffer to help you weather unforeseen expenses without resorting to debt or other forms of borrowing. Typically, people keep emergency funds in a savings account or a money market account, making them easily accessible in case of emergency.

Experts recommend that you have at least three to six months’ worth of living expenses saved in your emergency fund. The exact amount you need will depend on your circumstances, such as your job stability, income level, and number of dependents. In addition, it’s important to regularly review and update your emergency fund as your circumstances change.

Why Do I Need An Emergency Fund?

Without an emergency fund to fall back on, even a minor financial shock can have a significant and long-lasting impact on someone’s financial condition. Researchers have found that people who face difficulty recovering from a financial shock usually have a lesser reserve of emergency funds.

These people generally tend to rely on credit cards or secured/unsecured loans, which mostly leads to debt that is even harder to pay off. They might also try to balance things financially by pulling funds from other savings, such as retirement funds.

Emergency funds help one stay afloat in times of financial crisis without having to depend on high-interest loans or credit cards. Thus, building an emergency fund that can function as a rainy-day fund is extremely necessary.

How Much Do I Need In It?

The amount one must stash away as an emergency fund depends on several factors, including income, existing debt, number of dependents, etc. However, the general rule of thumb is to keep aside around 3-6 months’ worth of essential expenses. People with unstable jobs should save 6-12 months’ salary as an emergency fund.

Hence, the first thing one needs to do is to determine what constitutes their expenditure. Therefore, the initial step is to identify one’s expenditures. These typically comprise essential expenses, which denote the portion of income allocated for day-to-day necessities. Essential expenses can further be categorized into fixed and variable expenses.

- Fixed expenses include maintenance/rent, insurance premiums, mortgage payments, other loans(education/car), salary for staff (driver/house help), school fees, etc.

- Variable expenses include medicines, groceries, electricity, phone bills, internet, travel expenses, and other incidentals.

Frugality is the key to saving up for emergencies, goes without saying. People typically exclude expenses like dining out, spending on clothes, a gym subscription, etc., from their emergency fund considerations.

To put it in numbers, say, for example, if Mr. Agarwal’s living expenses amount to Rs. 30,000. Then his emergency fund should be between Rs. 90 thousand and Rs. 1.8 lakhs. However, this amount depends solely on Mr. Agarwal’s family situation.

Thus, The emergency fund of a person who is the sole earning member of a family will look different from that of a bachelor.

How Do I Build It?

Saving is doubtlessly a good habit. It’s important to plan, be consistent, and be disciplined when setting aside money for emergency funds. There is a wide range of strategies to save money for emergencies. One can use one or more strategies per your financial condition to build up your emergency fund.

1. Set A Goal

A definite savings goal plan is a time-tested method of saving up money. A plan helps one stay motivated and enthusiastic. While making a plan, one needs to consider their monthly income and expenses to clarify how much one can save. Then, one can fix a reasonable goal using a savings planning tool found in abundance online.

Using such a tool, one will be able to calculate the possible amount one needs to set aside each month to attain your goal. It also helps to identify the number of months it would take you to reach the goal. One needs to start by cutting down on unnecessary expenses. Be sure to allocate any extra money in your budget specifically for emergency funds.

2. Create A System For Making Consistent Contributions Of Emergency Fund

To be able to contribute towards the emergency fund consistently, one needs to be a strict disciplinarian. However, if one is not so, then creating an automatic savings plan is the best and easiest method to make your savings consistent.

An automatic savings plan is indeed quite simple. One must schedule a recurring deposit from either checking account into the linked savings account. The frequency of these deposits depends solely on how often one credit money into the checking account. It can also vary as per the user’s personal preferences.

Setting up an automatic savings plan removes the burden of manually transferring money. Moreover, when savings are automatic, one is less likely to spend the excess money on unnecessary purchases. In fact, in no time, savings will become a habit, and one can effortlessly grow their emergency fund.

3. Regularly Monitor Your Emergency Fund Progress

Regularly monitoring one’s savings is indispensable to the entire savings process. One needs to devise ways to keep them self motivated. It can either be in the form of jotting down a running total of one’s contributions towards the savings account or receiving an automatic notification on their account balance.

Regularly monitoring savings helps to have a fair idea about one’s progress. One should also know how much money they still need to save to meet their savings goal. Moreover, one can set small goals and reach them. One must also pat their back for successfully sticking to their savings habit and reaching the saving goal.

Where Should I Keep An Emergency Fund?

Where one is to put their emergency funds solely depends on their situation. Nevertheless, one needs to be mindful of putting their hard-earned savings. Ensure that you keep the emergency fund easily accessible, secure, and in a location where you are not tempted to spend it on non-emergencies.

Three crucial aspects one needs to consider while deploying an emergency fund, are as follows:

1. Security

Since an emergency fund is meant to help one overcome a financially tough situation. One should avoid putting in places where there is a chance of capital erosion in the short term. Hence, one must avoid equity-based mutual funds or any such options with proportionally high risk.

2. Accessibility

Since emergencies demand immediate action, one needs to ensure that emergency funds are conveniently accessible. This accessibility ensures fast responses to unforeseen situations, safeguarding financial stability.

3. Liquidity

Liquidity refers to how fast one’s investments can be converted to cash. Hence, one should avoid long-term deposits, provident funds, bonds, and national savings certificates, which either have an upper withdrawal limit or are redeemable after maturity.

Following are some of the options where one can put their emergency money:

- Cash – To keep the emergency fund accessible for use as and when required, one can store it at home. It is advisable to keep 15% of the emergency fund in liquid cash. However, it’s essential to be cautious to prevent the money from getting lost, stolen, or destroyed.

- Bank Deposits – One can keep another 15% of the emergency fund in their bank account. It not only imitates the risk of speeding away money for unnecessary purposes but also keeps it safe. In addition to this, one can also earn a small amount of money as interest on the savings bank account.

- Investment – Investing the remaining 70% of the emergency fund can be done in either liquid mutual funds or short-term deposits. Each of these debt instruments is highly liquid and has minimal risk, and one can liquidate these investments through a bank’s app or a broker. After liquidation, their bank account will receive the funds within one or two days.

30% of the emergency funds should be kept separately at home or in the banks so that they can be easily accessed and used for more minor emergencies.

Liquid mutual funds have a slight advantage over bank deposits. For a liquid fund, the entry barrier is low. Unlike a fixed deposit, one can save a minimum amount to invest in a liquid mutual fund. In addition, liquid mutual funds usually offer higher returns than standard bank deposits. Lastly, the concerned bank might levy a premature withdrawal penalty on the fixed deposit if withdrawn prematurely. However, this is not the case with liquid funds.

Also, read: Investment Options: Top 15 Picks for 2023

When Should I Use the Emergency Fund?

Emergency funds prove most valuable when you can differentiate between genuine emergencies and less immediate expenses. True emergencies such as unforeseen medical bills or a sudden job loss require accessing emergency funds whereas, it is not an emergency if you run short of money to buy non-essential things such as going for a trip or a movie.

Here are four critical situations where using emergency funds is justified.

- Job Loss Financial support – The recent situations, like COVID-19, have made the jobs very unstable. One never knows when they might be laid off, and in such situations having a safety net is very important. Having an emergency fund ready in such situations gives one some time to look for a new job while providing financial stability for some time.

- Medical expenses – A comprehensive Health Insurance Plan is undoubtedly the best way to combat medical emergencies. However, health insurance has its limitations too, and might not cover specific treatments. Hence, to meet those treatments’ expenses, one must rely on emergency funds.

- Emergency Home Repairs – While homeowners typically rely on insurance to cover home repairs, it might not cover all the expenses. In unforeseen damages, the emergency funds help to address immediate repairs without delays.

- Urgent travel expenses – Last-minute travel plans, whether for emergencies or any other reason, often require financial resources. Emergency funds help to cover these expenses without putting a strain on your pocket.

Emergency Funds Calculation

These funds are created to help you take care of financial demands that arise without prior intimation.

- Note down your monthly income: You have to include monthly income, your current salary, any second income, bonus, investment income, and any other income.

- Calculate monthly expenses note that monthly expenses include rent/mortgage, utilities, groceries, transportation, insurance premiums, loan payments, and other miscellaneous expenses.

- Determine the monthly amount spent on small expenses including dining out, shopping, movies, and small activities.

- Calculate the amount spent on travel including public transport and fuel etc.

- Evaluate the monthly amount spent including college fees, medical bills, family support, etc.

- Add Additional Expenses Include other monthly expenses like monthly subscriptions (gym, OTT services, etc.), gifting, insurance premiums, holiday expenses, recharge, etc.

Emergency Fund = Monthly Expenses x Number of Months

Finally, total your monthly expenses + recreational activities + amount spent on dependant + travel + other monthly expenses and multiply them by six. You know a lot of funds can be reserved for emergency funds.

Depends on how many month’s worth of expenses you want to cover with your emergency fund. The standard recommendation is usually between 3 to 6 months but it can depend on your risk factor. An emergency fund should be 6 times your monthly expenses. So, if you spend Rs. 40,000 per month, then your emergency fund should be Rs. 2,40,000.

Best Ways to Invest Emergency Funds

The best places for emergency fund investment are:

- A separate account other than your regular savings, so you won’t withdraw money regularly.

- A savings account that grabs the most interest possible.

- A readily available account for any emergency.

These are the key aspects of a high-yield savings account (HYSA). In a HYSA, you can earn high interest on your money and access emergency funds quickly without penalties or hassle.

A money market account is a special kind of savings account that can reward a higher interest rate to customers who save a large amount of money in their account. Money market accounts can provide a year of about 3% to 4% interest rate. Some banks offer money market accounts that come with a debit card which gives the facility instant access to your funds

CD stands for certificate of deposit. When you put money into this type of bank account, you’re telling the bank that you promise to let them hold onto your cash for a set amount of time. Your bank may offer a range of terms, commonly between a year and five years.

Generally, CDs get a higher savings rate than a standard savings account. However, one drawback of keeping an emergency fund in a CD, you usually incur a penalty for withdrawing funds before the CD matures. This makes it hard to access your money if required immediately.

Drawbacks of Emergency Funds

The primary drawback of emergency funds is that Investing money into an emergency fund reduces the chances of allocating any additional funds for different programs, such as paying down a mortgage or retirement money savings or paying down a mortgage. Thus, emergency funds may be overhead in achieving financial goals.

By adding money to the emergency fund, a person expects fewer chances for high returns. If you are expecting a high return on investment money in the stock market, bonds, or certificates of deposit. It may provide inflation-beating returns and allow your savings to grow through compound interest. Thus, emergency funds grab the opportunity to use one’s money to generate more wealth. Emergency funds allow the chance to leverage one’s money for wealth generation.

Key Takeaways on Emergency Fund

An emergency fund can be no less than a savior in times of economic crisis. However, an emergency fund needs to be dynamic. If one adds a family member or upgrades one’s lifestyle, their emergency fund should also reflect the proportionate changes in expenses.

To increase the limit of emergency funds, one can take up a side job. CheggIndia is one such company that offers remote opportunities to freshers, students, or professionals looking for part-time remote jobs.

One can join CheggIndia as a Q&A expert and earn a hassle-free side income from the comfort of their home. One can choose any subject they are proficient in, from Engineering, Business, Earth Science, Healthcare, Mathematics, and more. Solve questions posed by students and get paid for each accepted answer.

Frequently Asked Questions

How much are you supposed to have in an emergency fund?

The size of one’s emergency fund depends on various factors such as income, number of dependents, lifestyle, existing debt, etc. Although, the general rule of thumb is to set aside anywhere between 3-6 months’ worth of essential expenditure. Essential expenditure” refers to the expenses needed for day-to-day functioning.

What is the best for an emergency fund?

The best thing to do with an emergency fund is to deposit it in a savings account. This is because a savings bank account guarantees the liquidity of the funds. Liquidity is of high importance for an emergency fund. One can look for a savings account offering a reasonable interest rate. Moreover, there should be no minimum balance requirements or hefty maintenance charges.

Where should I allocate my emergency fund?

Allocating a total monthly fund into a designated bank account helps you to consistently grow and achieve the substantial savings you want. Preferably, you’d put your emergency fund into a high-yield savings account with high interest rates or you should use a savings account with a high interest and easy to cash that you’d need in an emergency.

What is an emergency fund?

An emergency fund is money that you keep on the side for a bad period. If you lose your job, your income stops and other misses happen but your expenses would not stop, the emergency fund comes in handy at that time.

You should always have 10% of the emergency fund available in cash, 20% of your emergency fund in your bank and 70% of your emergency fund should be in a fixed deposit.

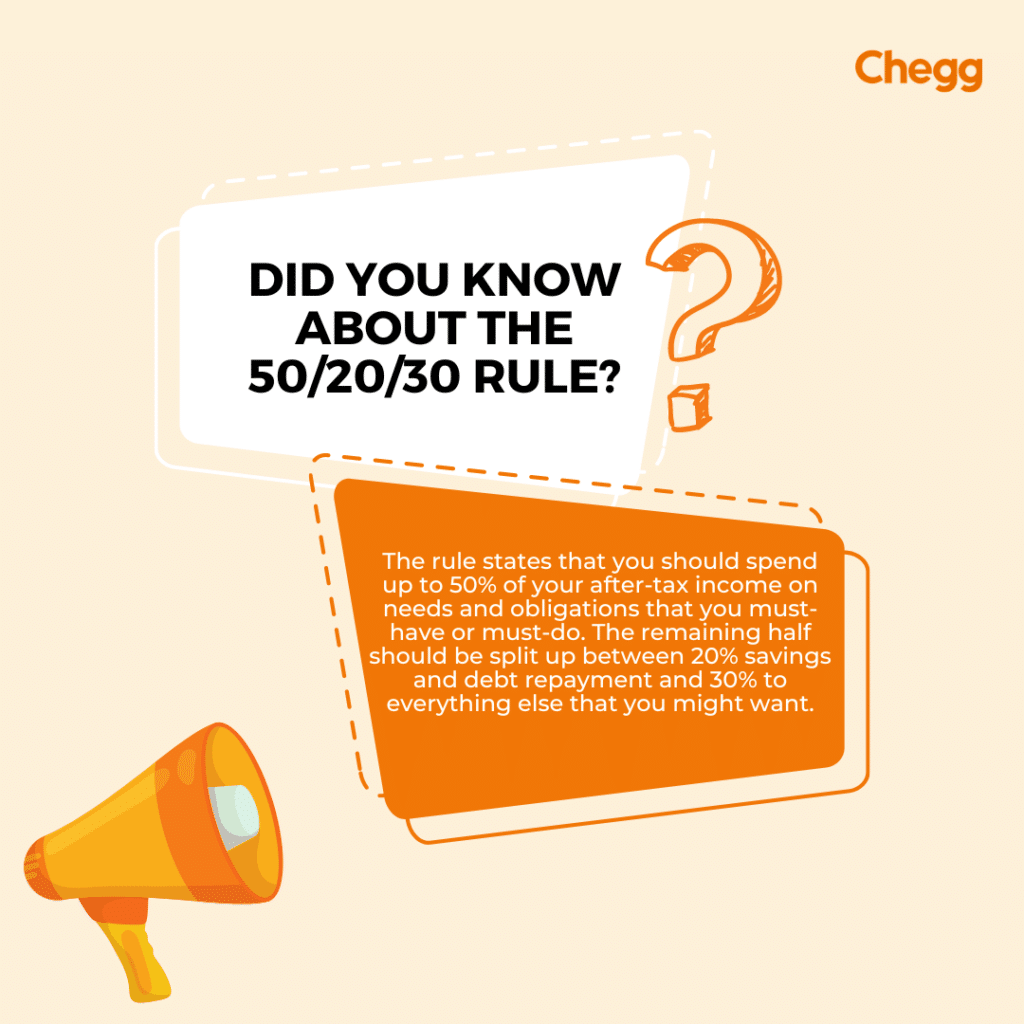

What’s the 50-30-20 budget rule?

Elizabeth Warren popularised the 50-30-20 budget rule, which states one must split their after-tax income into three categories in the ratio of 50:30:20. 50% of the after-tax income should be spent on needs and obligations. The next 30% must be spent on wants, and the rest 20% should be put aside as savings.

Here are some useful resources:

To read more related articles, click here.

Got a question on this topic?