Quick Summary

- CFA stands for Chartered Financial Analyst and MBA stands for Master of Business Administration.

- Individuals who are interested in investment analysis and portfolio management can opt for a CFA program.

- One looking for managerial and leadership positions in the business field should consider taking up an MBA program.

Table of Contents

What should I choose, CFA vs MBA? This is the choice that so many finance students and professionals struggle to make. The choice between pursuing a Chartered Financial Analyst (CFA) designation and obtaining a Master of Business Administration (MBA) degree is a critical decision for individuals aspiring to advance their careers in finance, investment, or business management.

Both CFA and MBA programs offer unique advantages, making it essential for professionals to carefully consider their goals, interests, and industry requirements before choosing a path of further education.

Here in the article, you will learn all about CFA and MBA, checking out both the pros and cons of each. So, let’s get started without any further delay.

About CFA and MBA

To compare CFA vs MBA, the two most renowned courses in India, we need to start with having a basic understanding of the two terms.

Chartered Financial Analyst (CFA)

CFA known as the Chartered Financial Analyst program is a globally recognized professional qualification for investment professionals. It is a self-study program that focuses on investment knowledge, ethical and professional standards, and practical skills. The program consists of three levels, each of which requires passing a six-hour exam. The curriculum covers topics such as economics, financial reporting, equity investments, fixed income, derivatives, alternative investments, and portfolio management.

The CFA designation is highly respected in the investment industry and is often required or preferred by employers. To become a CFA charter holder, candidates must have a minimum of four years of qualified work experience and adhere to a strict code of ethics.

Master of Business Administration (MBA)

Master of Business Administration (MBA), is a graduate-level degree program that covers various aspects of business, including management, marketing, accounting, and finance. This course is designed to equip you with the knowledge and skills required to excel in leadership positions in various industries.

MBA courses typically last two years and involve coursework, case studies, and real-world projects. During the course, you will also get the opportunity to network with professionals and gain practical experience through internships and other programs. Various career opportunities can be explored after an MBA which is particularly valuable for those seeking to advance their careers in the business world.

CFA vs MBA- Admission Process

|

CFA |

MBA |

|

The CFA course admission process is very simple. Eligible candidates have to register on the official website of ICFAI or CFA Institute. After you need to register for the Level I exam before September, and the exam is conducted in December. |

To gain admission in MBA finance, students need to clear entrance exams of respective colleges. Some exams are CAT, XAT, SNAP, MAT, CMAT, NMAT, etc. After securing a minimum percentile, candidates are called for Group Discussions and Personal Interview rounds. Some colleges also conduct tests like WAT, Team activity, and case study discussions. Candidates get admission to colleges after the successful completion of all the rounds. |

CFA vs MBA- Entrance Exam Format

|

CFA |

MBA |

|

For CFA, students need to clear three levels. All these exams are conducted in two sessions, morning, and afternoon.

|

The Common Admission Test (CAT) is the main entrance exam conducted for admission to top MBA colleges in India. It is a 3-hour online exam comprising multiple-choice questions. CAT consists of three sections:

Candidates need to clear the sectional and an overall cut-off for admission to MBA colleges. |

CFA vs MBA- Job Prospects

|

CFA |

MBA |

||

|

Job |

Average Salary (in INR) |

Job |

Average Salary (in INR) |

|

Equity Research Analyst |

10 LPA |

Accounts Manager |

8.6 LPA |

|

Financial Analyst |

5.8 LPA |

Cash Manager |

2.4 LPA |

|

Credit Analyst |

7.9 LPA |

Consulting Manager |

29.8 LPA |

|

Senior Financial Analyst |

8.3 LPA |

Credit Manager |

7.4 LPA |

|

Equity Research Associate |

12.5 LPA |

Corporate Controllers |

24 LPA |

|

Corporate Financial Analyst |

7.0 LPA |

Finance Officers & Treasurers |

5.5 LPA |

|

Auditor |

4.4 LPA |

Risk Manager |

11.5 LPA |

|

Consultant |

13.4 LPA |

Investment Manager |

6.1 LPA |

|

Portfolio Manager |

11.7 LPA |

Business Intelligence Analyst |

8.5 LPA |

Salary Source: Ambition Box

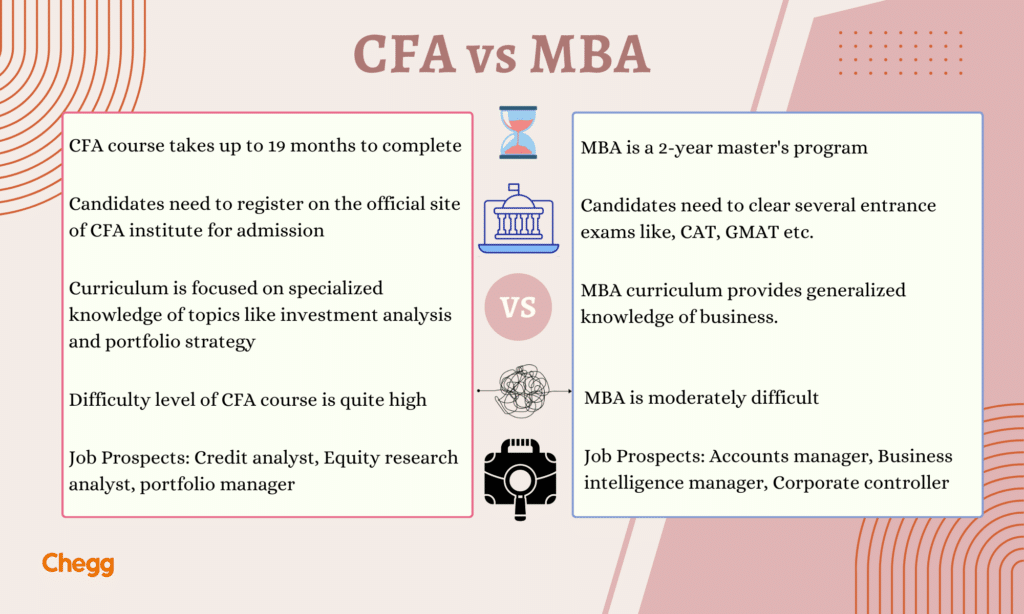

CFA vs MBA – At a Glance

|

Point of Difference |

CFA |

MBA |

|

Course Overview |

The Chartered Financial Analyst course focuses on several aspects of investment management and financial analysis. |

Master of Business Administration aims to provide students with in-depth knowledge of management studies. |

|

Eligibility |

Bachelor’s Degree in any discipline from a recognized institute. |

Bachelor’s Degree in any discipline from a recognized university. |

|

Institute |

AIMR – CFA Institute |

Almost all colleges such as IIMs, FMS New Delhi, etc |

|

Admission Procedure |

Registering on the official website. |

Entrance Exams – CAT |

|

Core Subjects |

|

|

|

Exam Format |

The course comprises three levels of Examination |

The Common Admission Test comprises three sections |

|

Course Fee |

INR 40,000 – 2.2 Lakh |

20,000 – 40 Lakh |

|

Duration |

1.5 – 4 Years |

2 Years |

|

Difficulty Level |

High |

Moderate |

|

Scope |

|

|

|

Average Salary (Annual) |

6.87 Lakh |

8.48 Lakh |

Who Should Choose CFA?

CFA (Chartered Financial Analyst) is a professional designation that is highly valued in the investment industry. The CFA course is designed for individuals who want to develop a deep understanding of investment analysis and portfolio management.

If you are interested in pursuing a career in finance, particularly in investment analysis, portfolio management, or investment banking, then the CFA program can be a great fit for you. It is also suitable for professionals who want to enhance their skills and knowledge in the field of finance, such as accountants, financial advisors, and economists.

In short, if you have a keen interest in finance and want to develop a deep understanding of investment analysis and portfolio management, then the CFA course is an excellent choice for you.

Who Should Choose an MBA?

An MBA (Master of Business Administration) is a graduate degree program that is designed to prepare individuals for management and leadership positions in the business. If you are someone who is looking to advance their career and gain knowledge and skills in areas such as finance, marketing, management, and operations, then an MBA course is the right choice for you.

An MBA can also be beneficial for those looking to start their businesses or to enter into fields such as consulting or investment banking. Overall, an MBA is a good choice for those who are interested in developing their business acumen and seeking opportunities for career growth and advancement.

CFA vs MBA- Which is Better?

After comparing CFA vs MBA, we can say that both are interesting and beneficial, but we need to asses them based on our interests. While an MBA teaches you to run a business managing money, people, products, and services, you study finance and money in-depth in CFA. But you first need to understand your interests to decide between the two options.

However, MBAs are better if we consider the growth factor. They can work in different categories other than their specialization. Therefore, in the beginning, the salary of an MBA is greater than that of a CFA.

On the other hand, CFA is a very specialized field. There are not many options after CFA. They are the people who know how to make money out of money. They may start at a lower salary package but can reach high levels by utilizing their potential.

Some people find a CFA course to be a bit tougher than an MBA. This is because the subjects are more specialized and advanced. On the contrary, the workload on MBA students is high. While pursuing an MBA, you start making networks and doing group projects and case studies. This helps you learn the demands and lifestyle of the corporate world. Whereas in a CFA, all you have to do is sit and study for the exams.

In the end, choosing between a CFA and an MBA depends on your needs, abilities and future goals. Trends and stats keep changing, you shouldn’t make choices based on that. Keep your end goal in mind and make the decision.

CFA vs MBA- Make your Choice Today!

Making career choices is never an easy task, but if you know what you want from your life then with little assistance, things can be made easier. After reading this comparative article between CFA vs MBA, you might have gotten to know what is best for you.

Your questions related to CFA and MBA, have been answered. Now, you are educated and informed to make your decision, so, go ahead and choose your path.

Evaluate numerous career choices to choose the right career path for yourself. Dive into our guide on Career Advice.

Frequently Asked Questions

Who earns more MBA or CFA?

CFA vs MBA who earns more, if general both the courses are great. However, if we see the career opportunities and earning potential, an MBA pass out will make more money than the CFA holder. The starting average annual income of an MBA is around ₹8LPA which can increase with experience, on the other hand, the starting package of CFA designation starts from ₹6LPA.

Is a CFA harder than an MBA?

Both the courses have challenges; however, the CFA course is considered a bit more difficult than the MBA course. The reason is the specialization subjects and in-depth study of each topic, need to be done in the CFA course.

Is CFA worth more than a masters?

The master’s course is considered great if you want to gain general knowledge of every subject, rather than going in-depth. However, the CFA course is tailor made for people who are interested in the field of asset management, portfolio strategy, and investment analysis.

To read more related articles, click here.

Got a question on this topic?