Quick Summary

One of the first questions asked during a job application is, “What is your current CTC?” or “What is current CTC full form?” To answer this effectively, it’s essential to understand what Cost to Company (CTC) means. CTC represents the total annual expenditure a company incurs on an employee. It includes not only the basic salary but also additional components such as bonuses, health insurance, provident fund contributions, and other perks or benefits. In essence, CTC reflects the complete financial investment an employer makes in an employee over the course of a year.

Your total compensation package is your current cost to company (CTC). Your CTC includes everything your employer spends on you, including gross salary, bonuses, allowances, and insurance or retirement contributions (e.g. provident fund). CTC is an all-inclusive figure to show the hiring and retention cost for you as an employee. Your in-hand salary is the amount you take home after deductions.

Simply put, CTC encompasses the total compensation a company provides an employee, including base salary, allowances, and benefits. In today’s competitive job market, stating your current and expected CTC clearly is vital when negotiating salary expectations and presenting your salary history. While many candidates prefer to discuss compensation toward the end of the interview, addressing it confidently early on can offer a strategic advantage in the hiring process.

CTC, or Cost to the Company, is the total amount a company spends on an employee annually, encompassing salary (gross salary, net salary, annual salary), benefits, bonuses, perks, etc. Understanding your current CTC is crucial for making informed career decisions, as it represents your overall compensation package from your prospective employer. Knowing your CTC helps you evaluate job offers, negotiate salary, and plan your finances effectively.

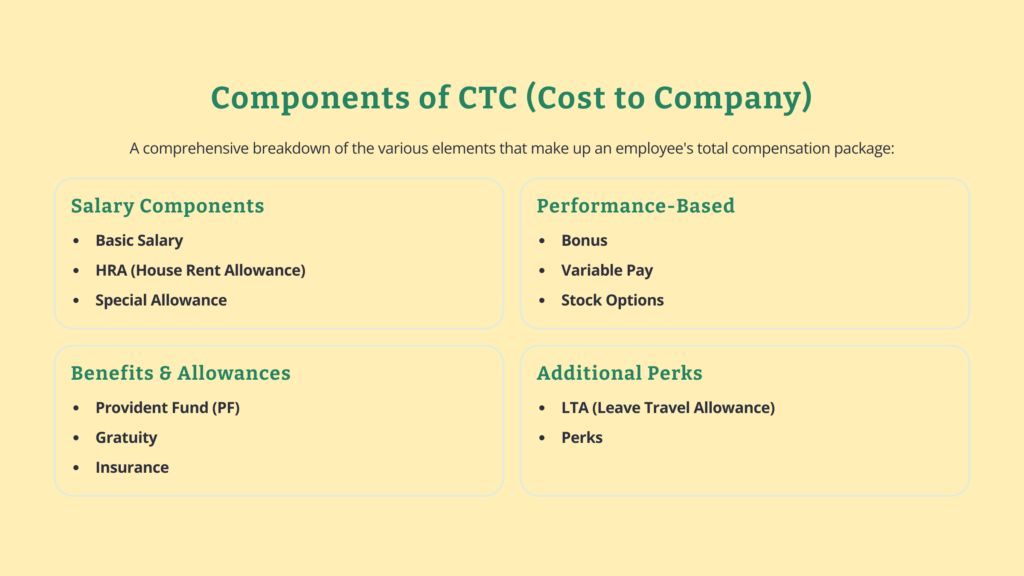

To calculate your CTC salary, you need to consider the following components:

By understanding the breakdown of your CTC, you can better evaluate your compensation package and make informed decisions about your career. This knowledge empowers you to negotiate effectively and ensure you receive fair and appropriate compensation.

I have researched and found that a fresher with my experience level can expect a CTC in the range of INR 2.5L to INR 5L per annum in India. This is my first full-time role, but I have worked as an intern, so I do not have a prior CTC as a fresher. As a fresher, clearly communicating your expected salary during job interviews is essential. I am open to discussing a salary package that aligns with my skills and job responsibilities. I am enthusiastic and believe in my potential to be valuable to the company.

Example 1:

My current cost to the company (CTC) is 12L per annum. After deductions, my basic salary is 6 lakhs, and the company provides additional allowances such as HRA, conveyance, and special allowances. I also receive performance incentives of 1-2 lakhs per annum and benefits such as health insurance, paid time off, and retirement benefits. While I am satisfied with my package, I am open to discussing any modifications based on the new job responsibilities. I would be happy to consider the salary range you have in mind for this role and work towards a mutually beneficial agreement.

Example 2:

My CTC is 15 lakhs annually, including fixed and variable components. The fixed component comprises a basic salary of 8 lakhs per annum and allowances such as HRA, conveyance, and medical reimbursements. The variable component includes performance incentives, which typically range between 2 to 3 lakhs annually. In addition to this, I also receive annual increments based on my performance and the company’s policies. It generally ranges from 12-18% per annum. While I am satisfied with my current package, I am open to discussing any adjustments based on the new job responsibilities and the company’s policies. I am open to discussing my expected salary based on the new job responsibilities and the company’s policies.

I’m currently earning a CTC of ₹8.5 lakhs per annum in my current role, which includes a fixed salary, HRA, travel allowance, and some performance-linked incentives. However, since I’m transitioning to a new domain that aligns more closely with my long-term career goals, I’m flexible in terms of compensation and open to discussing a fair offer that reflects the learning curve, my transferable skills, and future contributions.

My current CTC stands at ₹10 lakhs per annum, with ₹7 lakhs as fixed pay and the rest as variable and benefits. While the package has been fair for my current role, I am looking for growth-both in responsibilities and compensation. I believe the role I’m applying for provides that opportunity, and I’d be glad to discuss a suitable offer aligned with industry standards and the value I bring to the team.

I’m currently employed and receiving a competitive CTC that includes fixed pay, performance bonuses, and standard benefits. I’d prefer to understand the compensation range for this role first and am open to discussing a package that aligns with the responsibilities and my experience. My focus is on long-term growth and meaningful contributions.

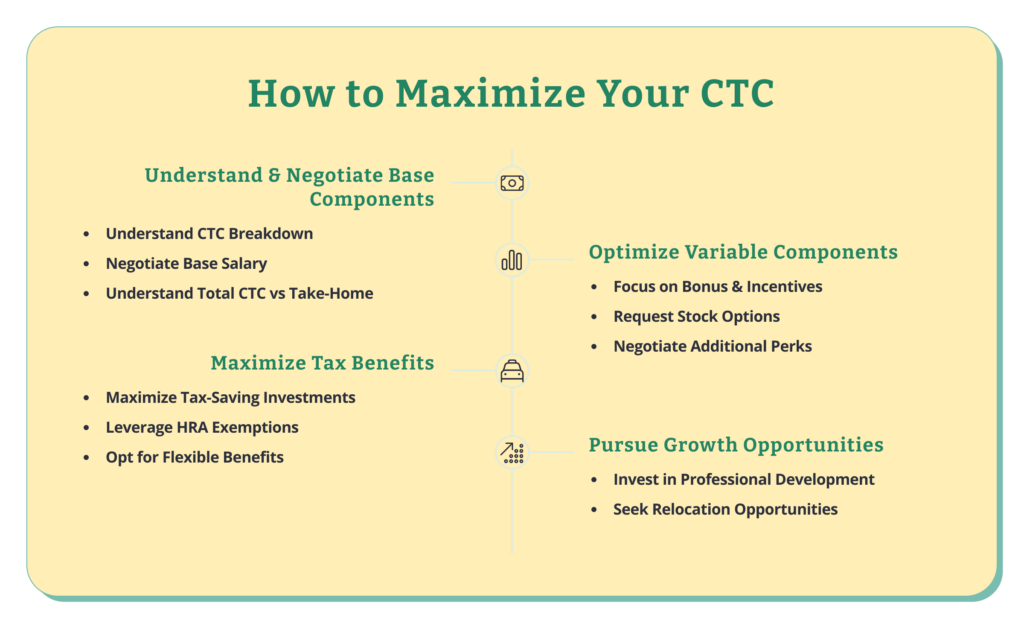

Though these are just samples, you need to focus on multiple aspects. Here are a few ways to help you gain the upper hand during salary negotiations.

CTC includes various components that an employee receives. Knowing them will help you answer the question better. Your answer should always be based on the fixed CTC.

The prominent components of your CTC are as follows:

An employee’s salary is usually divided into Fixed CTC and Variable CTC.

Fixed CTC:

Fixed CTC components include the basic salary, PF, and gratuity. These are fixed amounts paid to the employee regardless of performance.

The main components under the fixed CTC (direct benefits) are:

Variable CTC:

Variable CTC means components like bonuses, allowances, and other benefits based on the employee’s performance and can vary from year to year.

The main components under variable CTC are:

In summary, fixed CTC components are consistent amounts, while variable CTC components are performance-based. The direct benefits come under fixed components, whereas indirect benefits come under variable CTC.

In-hand salary or net salary refers to the amount the employee receives after all the deductions are made from gross salary. It is essential to understand this amount clearly, as it is the amount you will receive in your bank account.

The fixed components of your salary structure, such as basic salary, provident fund (PF), gratuity, and other allowances, remain constant and form a part of your in-hand salary. On the other hand, variable components, such as bonuses, incentives, and other performance incentives, may vary depending on your performance and target achievements.

When you discuss compensation with the employer during your job interview, ensure you know about all the deductions and savings contributions. You are satisfied with the net salary amount that you will receive.

Apart from the salary, employees also receive various benefits such as health insurance, life insurance, and other perks. These benefits significantly add to the overall value of the compensation package, and it’s crucial to discuss them during the salary negotiation.

Discussing these benefits ensures you receive a comprehensive salary structure. It’s also important to consider the monetary value of the benefits, such as the premiums for medical insurance and the company’s contribution toward retirement plans. These benefits include a travel allowance as well.

Therefore, it’s essential to clearly understand the benefits package to make informed decisions about your compensation package. Factors such as market rates, savings, provident fund contributions, direct benefits, annual management bonuses, and indirect benefits will help during salary discussions.

To negotiate your salary package effectively, you must be aware of the current salary trends in your industry. Research the average salaries offered for your job role and experience level. This research will help you set a realistic expected salary during negotiations.

You can research salary information through online job boards, salary surveys, and industry associations. You can also network with professionals in your field to get an idea of the going rate for someone with your skills and experience.

Ensure to have realistic expectations during the negotiation process. Knowing the current salary trends can also help you identify the areas where you can negotiate effectively.

Understanding your CTC components is essential for effective salary negotiation. For instance, you can request a higher basic pay if allowances are limited or if the company has budget constraints.

In some cases, the employer might not offer a higher salary but could be open to providing equity or stock options. You can also negotiate to convert certain benefits into direct cash allowances to increase your take-home pay.

While it’s up to you to quote your expected CTC, avoid inflating the figure or setting unrealistic expectations. Certain niche skills or high-demand roles may command better pay, but your quote should still align with current industry standards and the company’s budget.

Aim for a figure slightly above your current CTC, backed by market trends. If you’re aiming higher, be prepared to justify your expectations with solid reasons that highlight your value to the company.

When discussing your current CTC, providing a clear and concise breakdown of your total compensation package is essential. Here’s a suggested structure for presenting your CTC:

By structuring your response this way, you can confidently and effectively communicate your current CTC to potential employers or recruiters and forward your expected cost to the Company. This approach demonstrates your professionalism and ensures that you present a comprehensive view of your total compensation package.

Current CTC means an employee’s total compensation package annually, including the base salary and allowances, bonuses, benefits, and other perks the employer provides. When you negotiate your expected CTC with recruiters, you might wonder why recruiters ask for current CTC. Recruiters consider this to understand your skills, experience, and market value. They also use it as a benchmark to determine whether your salary expectations are realistic.

Here are a few points that will help you understand how recruiters use your CTC to determine how to meet your expected current CTC salary:

It is used as a benchmark to understand your current level of compensation and use that as a starting point for negotiations.

It also helps to understand the affordability of your expected CTC per annum for the organization.

It can help you determine the appropriate salary range for your desired position.

It is a reference point to determine your market value and whether your expected CTC is realistic and reasonable.

Recruiters use your current CTC as a basis for negotiations and may ask for proof of salary and benefits to support your expectations.

Recruiters may use it to understand your past salary increments and use that information to decide on the increment to offer you.

It helps to understand the fit of your current compensation package to the role you are applying for. For example, suppose your current package is significantly higher than the new role offers. In that case, it indicates you are overqualified or unlikely to be satisfied with the new role.

Recruiters may also consider the company’s salary increments and structure policies. Some companies have fixed salary increments, while others may have a more flexible approach.

Note: Understanding your current CTC per annum helps you evaluate job offers and negotiate better salary packages.

In conclusion, Current CTC means monthly or yearly, depending on the context. Still, it typically refers to an employee’s total annual compensation, including base salary, bonuses, allowances, and benefits. Understanding your current CTC is crucial for navigating salary discussions, evaluating job offers, and making informed career decisions. It’s not just about the base salary; knowing the full breakdown, including allowances, bonuses, benefits, and other perks, empowers you to effectively negotiate and align your compensation expectations with your career goals. By communicating your CTC confidently and transparently, you can secure a compensation package reflecting your skills, experience, and value in the job market.

Read More: Salary Calculator

CTC, or Cost to Company, is the sum a company spends on an employee, showing the total salaries or remuneration received in a year. It includes the following components:

Salary

Bonus

Benefits (medical coverage and retirement savings)

Other company advantages

Example: If the CTC value is ₹6 LPA, the in-hand salary after PF and tax deductions is ₹4.5 LPA.

Tip: Remember to check if the in-hand salary can meet your expected CTC; inquire about total in-hand salary, not only CTC.

For freshers in India, the CTC usually ranges from ₹3 to ₹6 LPA, especially in IT and service companies. If you have strong skills or join top firms, it can go up to ₹7–10 LPA.

Tip: Focus on building skills—CTC grows fast when your value grows!

CTC and gross salary are not same.

CTC refers to the entire cost the company incurs for or on behalf of the employee, including salary, bonuses, PF (Provident Fund), insurance, etc.

Gross salary is the actual amount an employee receives before any applicable federal and state income, medicare, and local taxes but after deducting PF and any other additional benefits received.

Tip: An employees in-hand paycheck will be less than either of those amounts, always, so make sure you ask to see the salary breakup!

It is preferable to focus on gross salary. It indicates what you will actually earn before tax. CTC includes compensation components that are not paid to you (like PF and insurance).

Tip: Always ask for your gross salary, and in-hand salary. CTC will always be larger but can be misleading!

Fixed salary constitutes the portion of your CTC that you receive every month, such as basic pay, HRA, miscellaneous allowances, etc. Fixed salary excludes bonuses, PF, or insurance plans.

Example: If you CTC is ₹6 LPA, your fixed salary should lie between ₹4.5-LPA to ₹5 LPA.

Tip: Fixed Salary is what truly matters – this is what you live on!

Authored by, Rashmi Jaisal

Career Guidance Expert

Rashmi is a Content Strategist who creates research-driven content focused on education, higher education policy, and online learning. She brings an energetic blend of expertise in technology, business, and literature, sparking fresh perspectives and engaging narratives. Outside of work, she’s a passionate traveler who enjoys journaling and curating visual inspiration through Pinterest boards.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.