Quick Summary

Table of Contents

The Minimum Wages Act 1948 is an important labour law in India aimed at safeguarding workers from unfair pay and exploitation. It empowers both the Central and State Governments to determine and periodically revise wage rates across scheduled industries. Enforced from 15 March 1948, the Act ensures that wages reflect essential needs like food, clothing, and housing for workers and their families.

These rates are determined by factors like cost of living, region, skill category (skilled, unskilled, semi-skilled), and type of employment. Ensuring fair wages not only improves workers’ living standards but also boosts productivity and reduces poverty. The Act acts as an economic safeguard, especially in unorganized sectors where wage abuse is common.

The Minimum Wages Act, 1948 was enacted to ensure that workers across India receive fair and legally enforceable wages, forming a key pillar of Indian labor law. Its primary purpose is to protect workers especially in unorganized sector from wage exploitation, while supporting a sustainable and equitable economy.

Originally passed in 1948, the Act has been amended over the years most notably in 2000, when the minimum wage floor level was revised to reflect changing economic conditions and rising living costs. It aims to:

The Act, introduced in 1948, marked a turning point in India’s efforts to ensure that all workers receive fair pay for their jobs. The 2000 amendment, reflecting a deeper understanding of economic dynamics, mandated a revision of the minimum wage floor level.

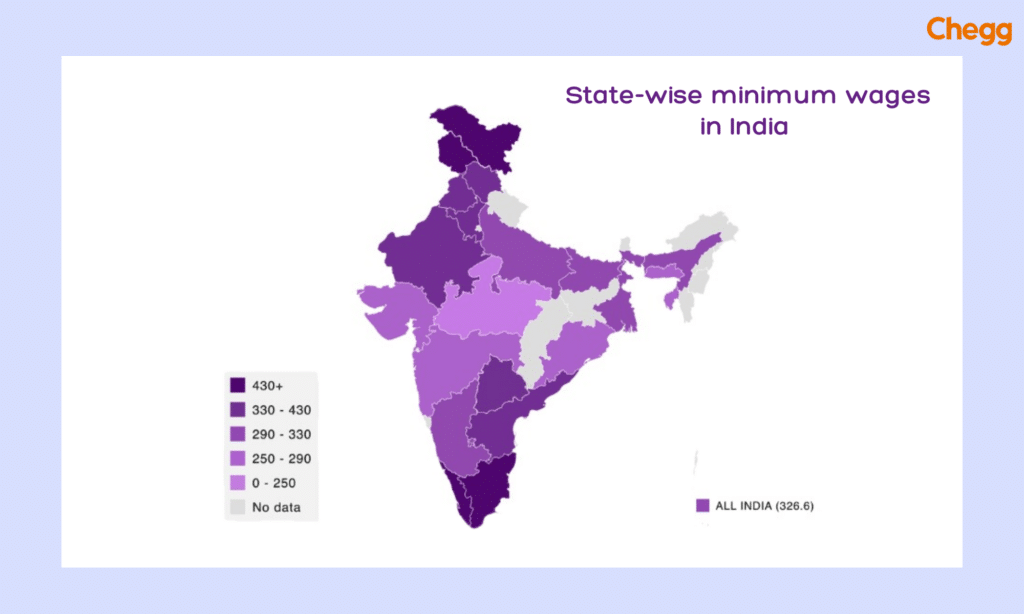

Currently, there are regional differences in India’s minimum wage environment. Andhra Pradesh, Kerala, and Gujarat have the lowest wages. These modifications highlight how flexible the Act is to the various economic settings found in different states.

The modified law’s awareness of the particular difficulties experienced by employees with disabilities is a commendable feature. To remedy this, the law raises the minimum wage for this group, in line with social justice and inclusion ideals.

The Act’s core consultation process necessitates government interaction with a committee of representatives directly affected by minimum wage decisions. This committee is crucial in setting the minimum wage since it considers work type, location, and skill level.

The government is subject to a tight deadline after the committee decides on the minimum wage. The established rate has to be enforced and published in official periodicals within three months to implement the decision quickly.

A fundamental component of the Minimum Wage Act is transparency. The government must publish the decision in a national daily to notify those impacted by the proposed minimum wage. Guaranteeing that stakeholders actively participate in the decision-making process promotes transparency and instills a sense of awareness and ownership.

The Act includes strict measures to strengthen compliance. When wages are not paid, the relevant authority has to make the necessary corrections as soon as possible. The fine is severe, though ten times the difference between the actual pay and the minimum wage if there is a delay or carelessness. This clause is a disincentive, emphasizing the importance of following the established minimum pay rates.

The Minimum Wage Act of 1948 serves as a strong defense for the rights and dignity of workers in India. It has been modified and adjusted in response to shifting economic circumstances.

Here’s a rewritten version of how minimum wages are calculated, free of plagiarism:

The minimum wage you see advertised isn’t the whole picture. Here’s what goes into calculating it:

These factors combine to determine the minimum wage an employee should receive.

Other Allowances

Employers may offer additional allowances, such as for transportation, overtime, and bonuses, which are designed to further support employees and incentivize performance or long hours.

2. Regional Variations

Minimum wage rates differ across states and regions in India due to the diverse cost of living. Urban areas generally have higher rates than rural regions to account for the higher living expenses in cities.

3. Skill-Based Wage Differentiation

Wages are also influenced by the skill level required for a particular job. Skilled labor, such as engineers or technicians, often earns a higher wage than unskilled or semi-skilled workers, even though all are guaranteed a minimum wage by law.

4. Sector-Specific Variations

The minimum wage can also differ based on the type of industry. For example, agricultural workers may have different wage rates compared to industrial or service sector employees, due to the nature and challenges of the work.

5. Overtime Pay

If workers exceed the regular working hours, they are entitled to overtime compensation. The minimum wage law ensures that workers receive fair pay for extra hours worked, typically at a higher rate than the standard wage.

6. Periodic Revisions

To keep up with the changing economic conditions, the Minimum Wages Act 1948 rates are reviewed periodically by the government. These reviews consider inflation, economic growth, and cost-of-living adjustments to ensure workers’ wages remain adequate.

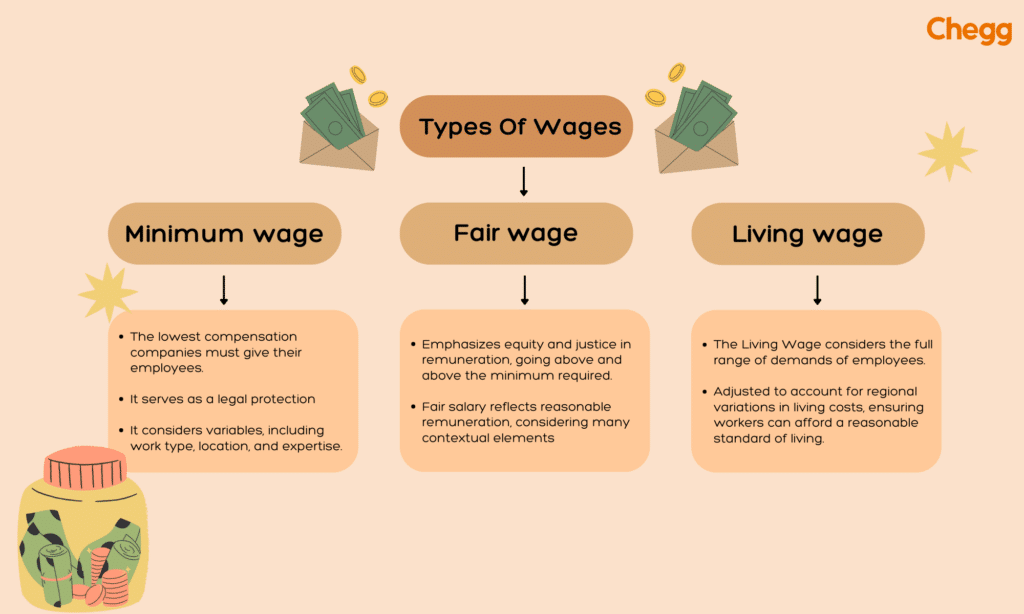

Different salary kinds control the compensation landscape in the Indian job market; each has a specific function related to the welfare of employees. This section examines the different types of wages.

The Minimum Wage establishes the lowest compensation companies must give their employees. It serves as a legal protection. This minimum wage in India is based on social justice principles and is a financial metric. Its goals are to stop worker exploitation and guarantee that all workers are paid enough to cover their basic requirements. It is a starting point and considers variables, including work type, location, and expertise.

A fair wage emphasizes equity and justice in remuneration, going above and above the minimum required. It tries to balance employers’ and employees’ financial interests. This salary type fosters a positive working connection between employers and employees by recognizing the employee’s abilities, output, and contributions. A fair salary reflects reasonable remuneration, considering many contextual elements, even though it may be more than the minimum wage.

The Living Wage considers the full range of demands of employees, striving to offer a quality of living that encompasses comfort, healthcare, education, and fundamental needs. It recognizes the more expansive facets of a life worthy of dignity beyond just sustenance. The living wage in India is adjusted to account for regional variations in living costs, ensuring workers can afford a reasonable standard of living.

A relevant minimum wage in India is crucial in balancing social fairness and economic development. The dual lens of economic and social aims highlights it. Beyond only being a legal obligation, it has evolved into a moral necessity that shows a dedication to the welfare of the workers.

A meaningful minimum wage is essential to accomplishing important goals in the complex economic fabric of India. Employers may stop labor exploitation by establishing a pay floor that guarantees workers a salary aligned with their cost of living. This financial safety net helps increase output because well-paid employees are more likely to be driven and invested in their jobs.

The demand for a decent minimum wage is firmly anchored in social goals independent of economic ones. India’s varied socio-cultural environment needs a pay system that considers employees’ fundamental necessities and upholds the dignity of labor. A significant minimum wage prevents the exploitation of those working in low-skilled or unorganized industries and works as a social safety net for society’s most vulnerable members.

Fixing wage rates (time, piece, guaranteed time, additional time) for any industry is made possible by the Minimum Wage Act of 1948.

Section 7 of the Minimum Wages Act provides for the establishment of an Advisory Board by the appropriate government. This board coordinates the committees and subcommittees formed under Section 5 and advises the government on fixing and revising minimum wages for Scheduled Employment.

Section 8 mandates the creation of a Central Advisory Board (CAB) by the Central Government. The CAB consists of an equal number of employer and employee representatives, along with independent members nominated by the Central Government. The Chairman of the CAB serves as a non-voting member. The CAB’s responsibilities include coordinating advisory activities across states, ensuring uniformity in minimum wage policies, and guiding the implementation of the Act.

The Minimum Wages Act of 1948 establishes the minimum hourly or daily wages for various occupations across India. Here’s a breakdown:

Challenges and Debates of Minimum Wages Act 1948:

Unskilled Labor: ₹800/day

Semi-skilled Labor: ₹900/day

Skilled Labor: ₹1,100/day

Urban vs Rural Differences:

Unskilled Labor: ₹700/day

Semi-skilled Labor: ₹800/day

Skilled Labor: ₹1,000/day

Urban vs Rural Differences:

Unskilled Labor: ₹750/day

Semi-skilled Labor: ₹850/day

Skilled Labor: ₹1,050/day

Urban vs Rural Differences:

Unskilled Labor: ₹600/day

Semi-skilled Labor: ₹700/day

Skilled Labor: ₹950/day

Urban vs Rural Differences:

This section establishes the Minimum Wages Act 1948 as the official name and specifies the geographic area to which the Act is applicable.

To ensure that everyone knows the Act’s contents, it defines essential terminology used throughout.

This provision gives authorities the authority to set minimum wage rates, which is essential in preventing exploitation and guaranteeing equitable recompense.

It lays forth the accurate minimum pay rates, which provide the basis for equitable remuneration in various industries.

This section provides a precise and systematic framework for setting and amending minimum wages.

The 1957 Amendment removed this provision, which dealt with the establishment and duties of advisory bodies.

This section introduces the idea of an advisory board, a consultative body that influences decisions about the minimum wage.

Similar to the Advisory Board, it establishes a Central Advisory Board, emphasizing a central-level consultative mechanism.

This section describes the organization and makeup of the committees tasked with setting and adjusting the minimum wage.

It allows authorities to correct mistakes made when setting or updating the minimum wage, guaranteeing accuracy.

An employee’s wages can sometimes be paid wholly or partly with goods instead of money; this is known as “wages in kind.” Normally, the law requires minimum wages to be paid in cash. However, if it is a traditional practice and the government approves it through an official announcement, payment in kind is permitted. The government then has specific rules for deciding the cash value of those goods.

It emphasizes employer responsibility by requiring the minimum rate of wages to be paid on time and in full.

It lays down standards for regular working days, guaranteeing workers fair hours.

Addressing overtime, Section 14 sets guidelines for compensating workers for hours worked beyond the typical working day.

This section addresses pay for employees who work for shorter than typical work days.

It outlines the approach to determining wages when a worker performs two or more work classes.

Section 17 sets minimum time rate earnings for work arrangements that involve pieces of labor.

Employers are required under Section 18 to keep correct registers and records about pay and employment.

It gives inspectors the authority to ensure that the Act is followed by conducting inspections and investigations as necessary.

Detailing the process for workers to claim their rightful wages, this section provides a mechanism for addressing disputes.

This section simplifies the claims procedure by enabling one application to cover several employees.

Section 22 establishes penalties for specific offenses, deterring violations of the Act.

Section 23 describes the circumstances under which employers may be excluded from liability under particular circumstances.

This clause prohibits filing lawsuits in cases covered by the Act, urging parties to use the Act’s procedures to resolve their differences.

To provide statutory Protection, it forbids contracts that permit parties to opt out of the Act’s obligations.

This section outlines the circumstances in which exemptions and exceptions may be applicable. In some cases, it offers flexibility.

Section 27 empowers State Governments to augment the Schedule, allowing for contextual adjustments.

This provision gives the Central Government the power to issue directives for the efficient execution of the Act.

Section 29 gives the Central Government the authority to create rules that complement the Act’s provisions.

Similar to Section 29, Section 30 grants the appropriate government the authority to establish rules for effective implementation.

The last section, Section 31, gives legal support to the conclusions made regarding the fixation of specific minimum pay rates.

This in-depth analysis of the Minimum Wages Act 1948 shows its complex provisions. It illuminates the broad framework it represents for defending the rights and welfare of workers in various industries in India.

The Minimum Wages Act, of 1948, discourages frivolous claims and ensures employee rights by outlining penalties:

The Act ensures both a deterrent against unfair employer practices and a mechanism for recouping lost wages for employees.

The Minimum Wages Act, 1948 serves as a crucial safety net for Indian workers, ensuring they receive fair compensation for their labor. It empowers both the Central and State Governments to set and revise minimum hourly or daily wages for various occupations across India. These wage rates are determined by considering factors such as the cost of living, skill levels, and local economic conditions. Industry-specific tripartite wage boards also contribute by recommending sector-based wage rates.

The Act mandates regular reviews of minimum wages, ideally every five years, to reflect changing economic realities. It also requires a dearness allowance review every two years to offset inflation, ensuring wages retain their purchasing power.

To promote fair labor practices, the Minimum Wages Act prescribes penalties ranging from fines to imprisonment for employers who underpay workers or violate wage orders. Workers who are underpaid have the legal right to claim compensation for the difference between the minimum wage due and the amount actually paid.

By preventing wage exploitation and promoting decent living standards, the Minimum Wages Act remains a cornerstone of labor rights in India. While challenges persist, such as ensuring transparency in wage fixation and addressing underpayment practices, the Act continues to play a vital role in protecting low-income workers and supporting economic fairness.

The Minimum Wages Act 1948 of India is essential for protecting the rights and welfare of its labor force. The Minimum Wages Act 1948 addresses economic inequality and promotes social justice at the same time. To ensure just compensation, improve lives, and foster a vibrant, fair labor market, it is imperative to make regular adjustments, execute policies effectively, and raise awareness about the Minimum Wages Act 1948.

Read More:-

The Minimum Wages Act, 1948 is a central legislation in India designed to ensure that workers in certain employments are paid at least a minimum rate, to prevent exploitation. It allows both the central and state governments to set and periodically revise wages based on skill levels, nature of employment, location, and cost of living.

No, employers must pay salaries that meet or exceed the minimum amounts stipulated in the Minimum Salaries Act. A payment that is less than the stipulated amount is illegal.

Minimum wages refer to the lowest amount of payment that an employer is legally required to pay a worker for their labor. Under the Minimum Wages Act 1948, these wages are set by the government to ensure workers receive fair compensation based on their skill level, work type, and region.

Any employee engaged in a scheduled employment, as defined under the Minimum Wages Act 1948, is eligible to receive minimum wages. This includes workers in agriculture, construction, manufacturing, and other sectors notified by the government.

Minimum wages are generally calculated on the basis of 26 working days in a month, assuming a 6-day work week. This excludes weekly holidays, which are not counted as paid days under the Act.

Wages are typically reviewed and revised every five years, but the government can revise them sooner to adjust for inflation or changing economic conditions.

There is no fixed “salary limit” under the Act that applies uniformly; minimum wage rates vary widely among states, sectors, skill levels (unskilled to highly skilled). The Act mandates that employers cannot legally pay less than the minimum wage fixed for that scheduled employment in that state.

As of recent updates, for unskilled workers under central/upper-wage bands, the minimum wage is about ₹783 per day, while for highly skilled workers it can go up to ₹1,035 per day under certain categories. These rates differ by state, skill category, and scheduled employment.

Authored by, Muskan Gupta

Content Curator

Muskan believes learning should feel like an adventure, not a chore. With years of experience in content creation and strategy, she specializes in educational topics, online earning opportunities, and general knowledge. She enjoys sharing her insights through blogs and articles that inform and inspire her readers. When she’s not writing, you’ll likely find her hopping between bookstores and bakeries, always in search of her next favorite read or treat.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.