Quick Summary

Are you getting ready for an accounting interview and wondering what questions you will face in 2025’s competitive job market? Whether you are a recent graduate or an experienced professional, accounting interviews now focus on more than just textbook knowledge.

They evaluate your real-world skills, ethical judgment, and problem-solving abilities. As industry standards change and new technologies shape the finance world, it is important to prepare for both technical and scenario-based questions that show your true capabilities.

In this guide, you will find the most common and challenging accounting interview questions, along with strategies to create standout answers. Using insights from recruiters and the latest industry trends, we will help you highlight your skills and build trust with employers.

Confidently take the next step in your accounting career. Whether you are seeking your first job or a senior role, this article will provide you with the knowledge and credibility you need to succeed.

Accounting interview questions are inquiries designed to evaluate a candidate’s knowledge of financial principles, practical accounting skills, and familiarity with tools like Excel or accounting software. These questions often cover topics such as journal entries, balance sheets, income statements, and tax regulations.

In addition to technical knowledge, interviewers may ask behavioral and situational questions to assess problem-solving abilities and attention to detail. Whether for freshers or experienced professionals, accounting interview questions aim to ensure the candidate can accurately manage and analyze financial data.

The fundamental accounting principles include Accrual Principle, Matching Principle, Consistency Principle, Prudence Principle, and Going Concern Principle. These ensure that financial information is reliable, comparable, and accurate.

Accounts Payable is the money a company owes to its suppliers, while Accounts Receivable is the money owed to the company by its customers.

Working capital is the difference between a company’s current assets and current liabilities. It measures the company’s liquidity and operational efficiency.

Accrual accounting records revenues and expenses when they are incurred, regardless of when cash transactions occur. It provides a more accurate picture of a company’s financial status.

Financial statements include the Balance Sheet, Income Statement, Cash Flow Statement, and Statement of Changes in Equity, summarizing a company’s financial performance and position over a specific period.

Accrual accounting recognizes revenues and expenses when they are earned or incurred, regardless of when cash is exchanged. In contrast, cash accounting only records transactions when cash is received or paid.

Most large businesses use accrual accounting to comply with Generally Accepted Accounting Principles (GAAP), as it provides a more accurate picture of financial health.

Handling complex reconciliations involves:

Under ASC 842, all leases longer than 12 months must be recorded on the balance sheet. For lessees, this means recognizing a right-of-use (ROU) asset and a lease liability.

The lease liability is calculated as the present value of lease payments, and the ROU asset includes that amount plus initial direct costs and prepaid lease payments.

Expenses are recognized over time based on the lease classification (finance vs. operating).

Deferred revenue is income received for goods or services not yet delivered. It’s recorded as a liability on the balance sheet because the obligation is not yet fulfilled.

For example, if a company receives $10,000 for a 12-month subscription, it initially records the full amount as deferred revenue and recognizes $833.33 per month as revenue over the contract period.

To ensure GAAP compliance, I:

During month-end close, we had only 3 days to finalize financials due to a system outage. I immediately prioritized tasks, coordinated with cross-functional teams, and worked late hours to meet our reporting deadline.

We completed the close on time with no compliance issues.

This situation taught me the importance of time management, teamwork, and staying calm under pressure.

While reviewing a quarterly report, I noticed a $150,000 discrepancy in deferred revenue. I retraced journal entries and discovered a posting error from an automated system.

I corrected the entry, documented the issue, and worked with IT to fix the system logic.

This experience highlights my attention to detail and commitment to financial accuracy.

Once, a colleague and I disagreed over the treatment of prepaid expenses. I initiated a professional discussion, supported my position with GAAP references, and listened to their concerns.

We consulted with the accounting manager and aligned on the correct approach.

I believe in handling conflicts with respect, open communication, and data-backed reasoning.

I noticed our manual invoice approval process caused delays in vendor payments. I proposed an automated workflow using our ERP system.

After implementation, approval times dropped by 40%, and we reduced late payment fees.

This change improved efficiency, vendor relationships, and overall cash flow management.

During a budget review with the marketing team, I used visuals and simplified terminology to explain variance analysis.

I translated financial terms into business impact language, helping them understand spending patterns and adjust future campaigns.

Clear communication is key when bridging the gap between finance and non-finance teams.

S (Situation): While working as an accounts assistant at a mid-sized retail firm, I noticed a ₹2.5 lakh discrepancy between our internal sales records and the monthly financial report.

T (Task): My responsibility was to identify the root cause, correct the error, and ensure accurate reporting before final submission to management.

A (Action): I traced the discrepancy by reconciling the point-of-sale (POS) data with the general ledger and bank statements.

I found that an invoice was double-entered due to a syncing error in the billing software. I corrected the entry, documented the issue, and proposed a two-step approval process for future entries.

R (Result): This resolved the discrepancy and improved the accuracy of monthly reports. Management implemented my recommendation, which reduced such errors by 40% over the next two quarters.

S (Situation): In my previous role at a logistics company, junior staff often had confusion regarding the use of the general ledger during our audits.

T (Task): I was asked by the finance lead to help train the new accounting interns on the importance and structure of the general ledger.

A (Action): I explained that the general ledger is the central repository of all financial transactions, categorized into accounts like assets, liabilities, revenues, and expenses.

I used real company examples to show how entries from source documents flow into the ledger and impact the trial balance and financial statements.

R (Result): My explanation helped the interns understand accounting flows better. It also reduced entry errors during the next reconciliation cycle by 25%.

S (Situation): At my previous job, month-end closing used to stretch beyond deadlines due to inconsistent procedures and missed entries.

T (Task): I was responsible for streamlining the month-end close and ensuring it was completed accurately and on time.

A (Action): I created a checklist that included steps such as recording all accruals and deferrals, reconciling bank accounts, reviewing journal entries, and preparing the trial balance.

I coordinated with other departments to get pending invoices and cross-verified receivables.

R (Result): This improved our closing time from 8 days to 5 days and increased accuracy, which was appreciated by both auditors and management.

S (Situation): During my internship, I was once assigned to enter transactions for a small client manually.

A senior accountant asked me to explain my approach to journal entries before proceeding.

T (Task): I had to ensure the entries followed double-entry accounting principles and were categorized properly.

A (Action): I explained that a journal entry records the financial impact of a transaction and includes the date, accounts debited and credited, amounts, and a brief description.

I ensured every transaction maintained the debit = credit balance, referencing supporting documents like invoices and receipts.

R (Result): My accurate entries helped build a clean audit trail. My supervisor praised my understanding and later assigned me to review junior entries as well.

S (Situation): When I volunteered at a small non-profit, their treasurer needed help organizing financial data using correct account classifications.

T (Task): My task was to educate the staff on account types to improve bookkeeping practices.

A (Action): I explained that there are five main types of accounts: Assets, Liabilities, Equity, Revenues, and Expenses.

I gave examples like “Cash” as an Asset, “Accounts Payable” as a Liability, and “Utilities” as an Expense. I also created a reference sheet that helped them map each transaction to the correct account.

R (Result): This improved their internal recordkeeping, and by the end of the quarter, their audit passed without adjustments or compliance issues.

By applying elimination entries, using intercompany transaction reconciliation, and following relevant accounting standards like IFRS 10 or ASC 810.

IFRS (International Financial Reporting Standards) are globally accepted, while GAAP (Generally Accepted Accounting Principles) is specific to the U.S. Key differences lie in revenue recognition, inventory methods, and treatment of development costs.

By using the Allowance Method or Direct Write-Off Method, companies estimate uncollectible accounts and record them as expenses to reflect true receivables value.

Cost accounting focuses on internal cost control and budgeting, while financial accounting deals with external reporting of financial statements to stakeholders.

Common software includes Tally, QuickBooks, SAP, Oracle Financials, Zoho Books, and Microsoft Excel. Proficiency depends on the role and industry requirements.

Revenue is recognized in five steps:

Hedge accounting aligns the accounting treatment of a hedging instrument (like a derivative) with the hedged item. It’s used to reduce earnings volatility due to market risk, and requires documentation, effectiveness testing, and compliance with IFRS 9 or ASC 815.

Transfer pricing involves setting prices for transactions between related entities in different jurisdictions. It’s critical for tax compliance, avoiding profit shifting, and ensuring arm’s length principles are followed under regulations like OECD guidelines.

Use key ratios such as:

Deferred tax assets (DTAs) arise when taxable income is higher than accounting income (e.g., due to tax loss carryforwards), while deferred tax liabilities (DTLs) arise when accounting income exceeds taxable income (e.g., depreciation differences). These result from temporary timing differences and impact future tax payments.

Under both standards, lessees must recognize a right-of-use (ROU) asset and a lease liability on the balance sheet for most leases. The asset is amortized and the liability is reduced over time, shifting lease accounting toward a capitalized model.

Fair value accounting reports assets and liabilities at their current market value rather than historical cost. It is used for financial instruments and investment properties under IFRS 13 / ASC 820, with a three-level hierarchy based on input observability.

Steps include:

Confidence comes from being prepared and understanding yourself. Get feedback from mentors, look over recent industry changes, and practice explaining your experiences clearly. With the right mindset and effective strategies, you’ll make a strong impression and take an important step toward your ideal accounting job in 2025 and beyond.

Under IAS 36 / ASC 360, assets are reviewed for impairment when indicators exist.

If carrying value exceeds recoverable amount (higher of fair value less costs or value in use), the asset is written down and the loss is recognized in P&L.

Key controls include:

Mastering accounting interview questions involves more than just memorising formulas. It’s about showing your knowledge, honesty, and ability to respond to changes in the industry.

By preparing relevant real-world examples and keeping up with the latest accounting standards, you’ll prove to employers that you can handle challenges and provide value from the start.

Before jumping into definitions, understand the reasoning behind key accounting principles. When answering accounting interview questions, explain not only what a concept means but also why it’s important. For example, don’t just say “accrual accounting records revenues when earned” — explain that it provides a more accurate view of financial health than cash accounting.

Interviewers love practical insights. When discussing accounting interview questions, tie your responses to real business situations. For instance, if asked about depreciation, talk about how companies use it to manage asset values and tax obligations.

For behavioral accounting interview questions, use the STAR method: Situation, Task, Action, Result. This is particularly useful when asked about resolving discrepancies, financial reporting challenges, or audit issues.

Many accounting interview questions test your awareness of current financial regulations like IFRS, GAAP, and ASC standards. Mentioning these proactively shows that you’re up-to-date and ready to add value from day one.

If you’re interviewing for a junior role, don’t overcomplicate your answers. For senior or specialized roles, delve deeper into standards, compliance, and analysis. Always align your answers for accounting interview questions with the level of expertise required.

Read More: BCom Accounting and Finance Course Details in India

Mastering accounting interview questions involves more than just memorizing formulas. It’s about showing your knowledge, honesty, and ability to respond to changes in the industry. By preparing relevant real-world examples and keeping up with the latest accounting standards, you’ll prove to employers that you can handle challenges and provide value from the start.

Confidence comes from being prepared and understanding yourself. Get feedback from mentors, look over recent industry changes, and practice explaining your experiences clearly. With the right mindset and effective strategies, you’ll make a strong impression and take an important step toward your ideal accounting job in 2025 and beyond.

Evaluate numerous career choices to choose the right career path for yourself. Dive into our guide on Career Advice.

Read More: Accounting Interview Questions and Answers

1. Can you explain the three main financial statements?

2. What is the difference between accounts payable and accounts receivable?

3. How do you ensure accuracy in financial reporting?

4. What accounting software do you know well?

5. How do you handle tight deadlines during audits?

6. What is the difference between accrual and cash accounting?

7. How do you manage tax compliance and regulations?

8. Can you explain the concept of working capital?

9. What steps do you take to prevent accounting errors?

10. Describe a challenging accounting problem you solved.

The main accounting question is: “How can a business record and report its financial transactions to show its true financial position?”

The five basic accounts in accounting are Assets, Liabilities, Equity, Revenue, and Expenses. They form the foundation for correctly recording, classifying, and reporting financial transactions.

Depreciation of $10 means spreading a $10 part of an asset’s cost as an expense over its useful life.

For instance, if a $100 asset loses $10 in value yearly, its book value drops by $10 annually. This change shows wear and tear, usage, or obsolescence.

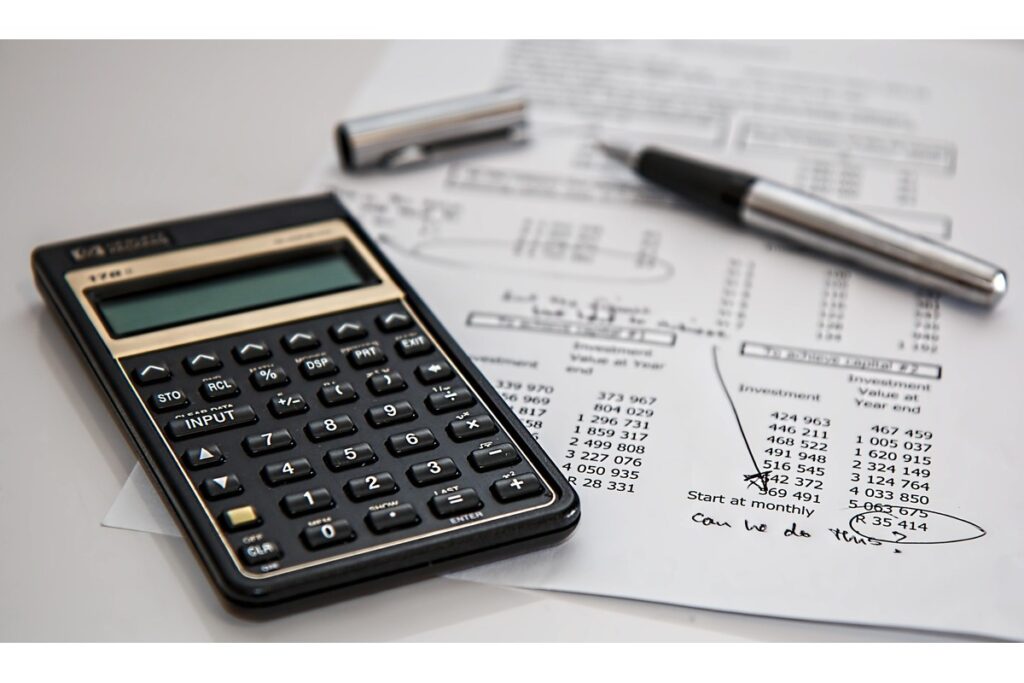

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is calculated like this:

EBITDA = Net Profit + Interest + Taxes + Depreciation + Amortization

Authored by, Rashmi Jaisal

Career Guidance Expert

Rashmi is a Content Strategist who creates research-driven content focused on education, higher education policy, and online learning. She brings an energetic blend of expertise in technology, business, and literature, sparking fresh perspectives and engaging narratives. Outside of work, she’s a passionate traveler who enjoys journaling and curating visual inspiration through Pinterest boards.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.