Quick Summary

Table of Contents

These top 10 banks in India dominate the banking landscape by a mix of robust public and private institutions dominated by . The State Bank of India (SBI) leads as the largest, both in terms of deposit base and government backing making it “too big to fail” and widely regarded as the safest. Among private banks, HDFC Bank holds the top spot by assets and market capitalization, known for its tech-forward approach and recognition as a Domestic Systemically Important Bank (D-SIB). Other major private players ICICI Bank, Kotak Mahindra Bank, Axis Bank, and IndusInd Bank also feature prominently, backed by strong financial metrics and expansive branch networks.

Government-owned entities like Punjab National Bank, Bank of Baroda, and Union Bank of India remain vital for their scale and reach. Together, these institutions drive India’s financial stability, inclusion, and digital evolution.

In today’s fast-paced world, banking isn’t limited to long queues and passbooks. With advanced digital services, mobile banking apps, and paperless transactions, modern banks bring financial services to your fingertips. At the same time, they’re also strengthening India’s financial inclusion goals by offering affordable services to rural and underserved communities.

India’s banking landscape is diverse and dynamic. It includes a healthy mix of long-established public sector banks, highly efficient private sector banks, and new-age players focusing on digital banking. Whether you’re looking to open a savings account, apply for a personal or business loan, invest in mutual funds, or simply transfer money with ease knowing the right bank for your needs can make a huge difference.

In this blog, we’ll explore the Top 10 Banks in India, covering their origins, unique offerings, digital tools, and how they cater to individuals, entrepreneurs, and large-scale businesses alike. By understanding what each bank offers, you’ll be better equipped to choose the one that best aligns with your financial goals.

| Bank Name | Type | Headquarters | Year Founded | Market Capitalization (INR Crore) |

|---|---|---|---|---|

| HDFC Bank | Private Sector Bank | Mumbai, Maharashtra | 1994 | ₹12,94,094.99 |

| ICICI Bank | Private Sector Bank | Mumbai, Maharashtra | 1994 | ₹8,85,788.79 |

| State Bank of India (SBI) | Public Sector Bank | Mumbai, Maharashtra | 1955 | ₹6,51,229.52 |

| Kotak Mahindra Bank | Private Sector Bank | Mumbai, Maharashtra | 2003 | ₹3,91,782.81 |

| Axis Bank | Private Sector Bank | Mumbai, Maharashtra | 1993 | ₹3,08,515.22 |

| Bank of Baroda | Public Sector Bank | Vadodara, Gujarat | 1908 | ₹1,10,444.78 |

| Punjab National Bank (PNB) | Public Sector Bank | New Delhi | 1894 | ₹1,06,723.47 |

| IndusInd Bank | Private Sector Bank | Pune, Maharashtra | 1994 | ₹80,694.17 |

| Canara Bank | Public Sector Bank | Bengaluru, Karnataka | 1906 | ₹79,876.16 |

| Union Bank of India | Public Sector Bank | Mumbai, Maharashtra | 1919 | ₹87,725.40 |

When we talk about “safest banks” in India, we aren’t just referring to trust but also resilience under stress. The Reserve Bank of India (RBI) identifies three banks as Domestic Systemically Important Banks (D-SIBs) SBI, HDFC Bank, and ICICI Bank meaning their potential failure could ripple through the entire financial system. These banks are required to hold extra capital buffers, making them especially stable even in turbulent times.

Quick Facts

| Bank | D-SIB Bucket | Additional CET1 Requirement (from April 2025) | Why It Matters |

|---|---|---|---|

| SBI | Bucket 4 | 0.80% | Highest systemic importance; strongest safety net |

| HDFC Bank | Bucket 2 | 0.40% | High-capital buffer post-merger with HDFC Ltd. |

| ICICI Bank | Bucket 1 | 0.20% | Designated D-SIB with lower surcharge, still stable |

Domestic Systemically Important Banks (D-SIBs) are those whose failure would pose a serious threat to the stability of India’s financial system. Under the RBI’s 2014 framework:

We looked at more than just market cap to rank the best banks in India. Here are the key factors:

Public Sector Banks (PSBs):

These are banks in which the Government of India holds a majority stake (more than 50%). They are backed by the government and focus on providing accessible banking services to all sections of society, especially in rural and semi-urban areas. Examples include State Bank of India (SBI), Punjab National Bank (PNB), and Bank of Baroda.

Private Sector Banks:

These are banks owned and operated by private individuals, corporations, or institutions, where the government holds little to no stake. They emphasize profitability, customer service, and technological innovation. Examples include HDFC Bank, ICICI Bank, and Axis Bank.

Public and private sector banks differ in who owns them and how they work. The government mainly owns public sector banks. Let’s look at the key differences between the two:

| Aspect | Public Sector Banks | Private Sector Banks |

| Ownership | Owned by the government. | Owned by private individuals or companies. |

| Reputation | Known for stability and trust due to government backing. | Known for innovation and efficiency due to profit-driven operations. |

| Focus | Serve everyone, with a special focus on financial inclusion programs. | Focus on profitability and customer convenience. |

| Advantages | – Long-standing trust and reliability.- Large branch networks, even in rural areas.- Lower fees and interest rates for broader accessibility. | – Seamless digital banking experience through the latest technology.- Personalized services tailored to specific needs.- Faster approvals for loans and other services. |

| Target Customers | Ideal for those seeking stability, affordability, and accessibility in banking. | Ideal for those seeking convenience, speed, and tailored solutions. |

| Technology and Innovation | Relatively traditional; focus on large-scale accessibility rather than cutting-edge technology. | Highly innovative, emphasizing the use of advanced technology for enhanced customer experience. |

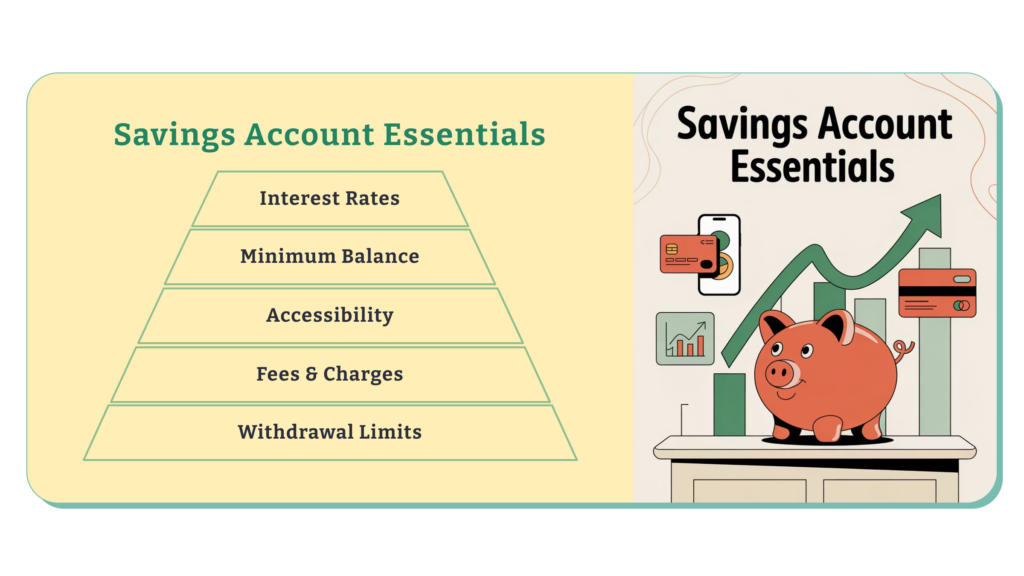

Choosing the best savings account in India isn’t a one-size-fits-all decision; it depends on your financial needs and lifestyle. To help you make the right choice, consider the following essential aspects:

India’s top 10 banks play a significant role in shaping the country’s financial system. They offer a wide range of services for both individuals and businesses. Private banks like HDFC Bank and ICICI Bank are known for their strong market presence, while public-sector banks like SBI and PNB are trusted for their stability. These banks support India’s economic growth with their extensive networks, technology-driven services, and customer-focused strategies.

If you’re exploring the top 10 Banks in India, knowing what each offers can help you choose the right one. Whether you’re looking for user-friendly digital platforms, competitive loan options, or unique financial products, these banks have something for everyone. Together, they build an inclusive and forward-looking financial system, helping create a brighter future for all.

Read More:

The State Bank of India (SBI) is one of the top 10 Banks in India and the most significant public sector bank in India. Founded in 1955, SBI has earned trust over the years. It provides various financial services, from personal banking to corporate finance. With over 22,000 branches and a strong presence in several countries, SBI is easily accessible to millions. If you’re looking for reliable banking, SBI is a top choice.

HDFC Bank is often considered one of the top 10 Banks in India. It is the leader among private banks in India. It stands out for its innovation and high-quality service. HDFC focuses on digital banking, making transactions quick and easy through online and mobile banking. It offers many products, including personal loans, credit cards, and investment options. HDFC Bank is known for great customer service and has built a strong reputation for being reliable and forward-thinking.

The top 10 banks in India provide various services to meet your financial needs. You can open savings and current accounts to keep your money safe. They also offer loans to help you achieve personal or business goals. Banks give you credit cards and investment tools to help you manage and grow your wealth. With digital banking, you can access your account anytime using apps and online platforms, making banking more convenient than ever.

According to multiple sources, the top banks in India (a mix of private and public) are:

HDFC Bank

ICICI Bank

State Bank of India (SBI)

Kotak Mahindra Bank

Axis Bank

Private sector banks are known for quick and efficient services. They focus on technology, offering easy-to-use digital tools for managing your finances. These banks provide personalized services, so you get solutions that fit your needs, like home loans, wealth management, or unique credit cards. Private banks are also known for excellent customer service, often responding faster than public sector banks.

HDFC Bank is considered the largest bank in India based on market capitalization. It also holds the position as the best and largest private bank in India.

Overview of the 10 Best Banks in India 2025

1. HDFC Bank. HDFC Bank is one of the most popular banks in India, with its headquarters in Mumbai.

2. ICICI Bank. ICICI Bank is an Indian multinational financial services bank headquartered in Mumbai.

3. SBI.

4. Kotak Mahindra.

5. Axis Bank.

6. IndusInd Bank.

7. Bank of Baroda.

8. Punjab National Bank.

According to multiple sources, the top banks in India (a mix of private and public) are:

HDFC Bank

ICICI Bank

State Bank of India (SBI)

Kotak Mahindra Bank

Axis Bank

IndusInd Bank

Bank of Baroda

Punjab National Bank (PNB)

Union Bank of India

Canara Bank

Authored by, Muskan Gupta

Content Curator

Muskan believes learning should feel like an adventure, not a chore. With years of experience in content creation and strategy, she specializes in educational topics, online earning opportunities, and general knowledge. She enjoys sharing her insights through blogs and articles that inform and inspire her readers. When she’s not writing, you’ll likely find her hopping between bookstores and bakeries, always in search of her next favorite read or treat.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.