Quick Summary

Are you curious about the legal issues that shape the business landscape? Corporate law courses can lead you to a rewarding career where legal knowledge meets industry change. In 2025, as companies deal with mergers, acquisitions, compliance, and international regulations, the need for skilled corporate lawyers is at an all-time high. Whether you are a law student, a working professional, or someone thinking about a career change, understanding the latest trends and chances in corporate law education is important for staying competitive.

This guide, backed by experts, covers a wide range of corporate law courses, including undergraduate, postgraduate, and diploma programs. It details their requirements, curriculum, and practical use. With advice from leading educators and legal professionals, you will learn how to choose the best path, build your expertise, and become a trusted advisor in the constantly changing world of corporate law.

Public finance is the study of how governments manage their income and expenditures to provide public services and promote economic stability. A key distinction exists between public and private finance, as public and private finance differ in their objectives and management of funds. The functions of public finance include resource allocation, economic stabilization, income redistribution, promoting economic growth, and ensuring social welfare. Public finance involves the management of financial resources by governments through processes such as budgeting, revenue collection, and expenditure.

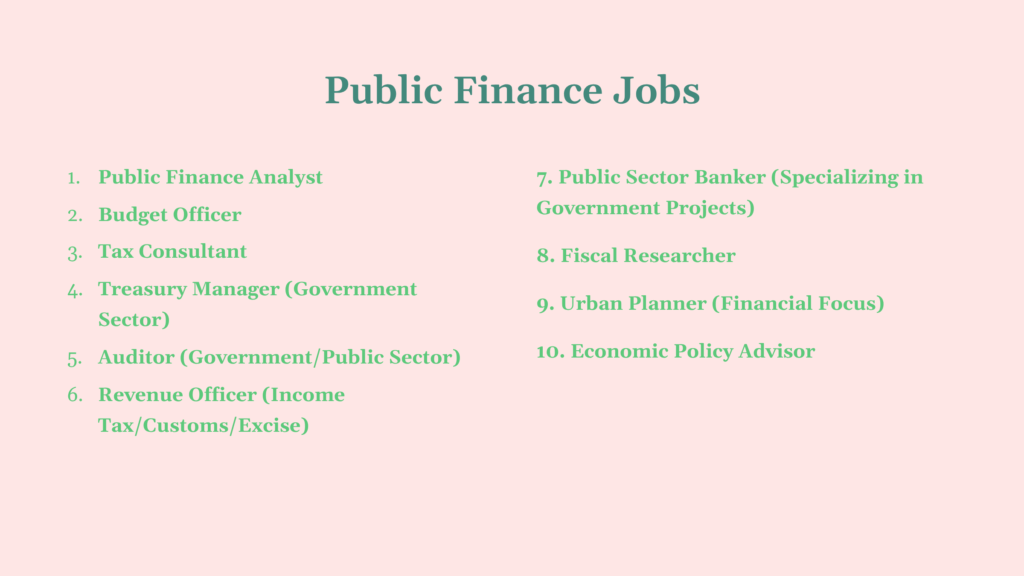

The scope of finance is huge. Below are the types of jobs that are available in the field:

A Public Finance Analyst plays a vital role in analyzing government budgets, tax structures, and expenditure patterns. Knowledge of public finance economics is essential for analyzing government budgets and fiscal policies, as it provides the framework for evaluating government performance and resource management. This role lies at the heart of the scope of public finance, where understanding fiscal policies and their impact on the economy is crucial. These analysts work in government departments, financial institutions, or research organizations to assess financial strategies and suggest reforms.

A Budget Officer is responsible for preparing and managing the government’s budget. This job directly aligns with the principles of finance, as it involves resource allocation, forecasting, and financial planning for public programs. Budget Officers are essential in ensuring that government spending is done efficiently and within the approved fiscal framework.

A Tax Consultant advises individuals and organizations on tax compliance and planning. In the context of finance, tax consultants contribute by helping increase tax collection and ensure compliance with regulations. They play a pivotal role in shaping how tax systems function within the larger fiscal policy environment.

Working in the government sector, a Treasury Manager oversees cash flows, investments, and funding strategies. The role is crucial in understanding the scope of finance, especially in managing public debt and liquidity. Their financial decisions impact how public funds are maintained and allocated for national development.

An Economic Policy Advisor develops fiscal strategies and policy recommendations that affect national and regional economies. This job represents the application of finance knowledge at the highest level, influencing decisions on taxation, subsidies, and welfare schemes. Advisors often work with think tanks, government agencies, and international bodies.

A Government Auditor ensures accountability and transparency in public spending. This position is vital in upholding the integrity of the public finance system by auditing public accounts and verifying the proper use of taxpayer money. Auditors also suggest improvements to financial processes and policies.

A Revenue Officer is tasked with enforcing tax laws and ensuring compliance across individuals and businesses. This job role directly links to the scope of public finance, focusing on the collection and regulation of public revenue. Revenue officers are employed by government taxation departments and play a crucial role in nation-building.

Public Sector Bankers working on government-related projects help finance infrastructure, social welfare programs, and other public investments. Their work often intersects with finance, particularly in disbursing funds, assessing risks, and implementing government-backed financial schemes. Public sector bankers may also collaborate with the private sector through public-private partnerships, facilitating private investment in public infrastructure projects to promote economic development.

A Fiscal Researcher investigates taxation systems, public expenditures, and fiscal policies. This job falls under the broader scope of public finance, contributing valuable data and analysis to improve governance and economic efficiency. These professionals often work for universities, research institutes, or financial publications.

An Urban Planner with a financial focus works on the budgetary aspects of city development, such as infrastructure funding, zoning, and public service costs. Understanding finance principles is essential in this role to balance public investments with financial feasibility, ensuring that urban growth is sustainable and economically sound.

Below are the location, salaries and roles of jobs in the field of finance: Check it out:

Public finance serves key functions in society, such as resource allocation, economic stabilization, income redistribution, promoting growth, and supporting social welfare. In contrast, private finance focuses on maximizing wealth and managing finances at the individual or corporate level. This makes public finance essential for careers in public policy, taxation, auditing, and financial administration. To enter this field, students and professionals can pursue a variety of specialized courses, ranging from undergraduate programs to advanced certifications. Here are some of the most prominent finance courses available:

A foundational step toward a career in public finance, this undergraduate degree introduces students to microeconomics, macroeconomics, public policy, and governmental fiscal systems. This program is ideal for students aspiring to work in government departments, research institutions, or financial consultancies.

Offered by top institutions like the National Institute of Public Finance and Policy (NIPFP), Delhi School of Economics, or international universities, this course provides in-depth knowledge of budget analysis, fiscal policy, taxation, and expenditure control. It is a highly regarded qualification for government and policymaking roles.

This specialized diploma, available in institutions such as IIPA (Indian Institute of Public Administration), is tailored for professionals working in the government or public sector. It covers the scope of public finance, including budgetary processes, performance budgeting, and financial accountability.

While not exclusively about public finance, CA offers modules in taxation, auditing, and financial reporting which are critical for public financial roles, especially in government audits and financial consultancy for public institutions.

This short-term professional certification is designed for finance officers, clerks, and accountants in the public sector. It focuses on the practical applications of finance in accounting, auditing, and compliance with government rules and regulations.

Aspiring lecturers or researchers in the field of public finance can appear for the UGC-NET exam in relevant subjects. Qualifying this opens doors to teaching positions in Indian universities or pursuing a Ph.D. in the field.

This rare but increasingly valuable specialization within MBA programs prepares candidates for leadership roles in public-sector finance. It blends strategic management with an understanding of fiscal policies, taxation systems, and regulatory frameworks.

Platforms like Coursera and edX offer flexible learning options for students and professionals looking to upgrade their skills in finance. Topics include fiscal decentralization, public budgeting, taxation policy, and government debt management.

A research-focused path, this doctoral program delves deep into fiscal theory, government budgeting, and taxation systems. Scholars often contribute to policy development or become experts in government advisory roles.

For those aiming for prestigious positions in the Indian Administrative Services (IAS) or Indian Audit and Accounts Service (IAAS), opting for finance–related subjects can enhance their understanding of the country’s fiscal system and boost their career potential in government.

2. Developing countries paid $921 billion in net interest in 2024, a 10% rise over 2023—crowding out public investments in health, education, and climate.

3. 61 developing countries spent ≥10% of government revenues on interest servicing in 2024, limiting critical development spending.

4. About 3.4 billion people live in countries spending more on interest than on health or education, intensifying inequality and development challenges.

5. External debt servicing ratios surged: World Bank reports low‑income developing economies paying up to 13.5% of export earnings in 2024—triple levels from 2010; middle‑income economies similarly hit double‑digit debt service burdens

India’s public finance framework is anchored by the FRBM Act, which mandates fiscal prudence, targeting a fiscal deficit of 3% of GDP and debt-to-GDP below 60%. Though implementation has seen relaxations—especially post-COVID—FRBM remains critical in guiding both central and state-level fiscal consolidation. The 15th Finance Commission recommended a fresh roadmap, calling for enhanced transparency, accountability, and medium-term expenditure frameworks.

GST has transformed indirect taxation into a unified structure across states and the Centre. While initially plagued by compliance issues and rate complexities, GST has stabilized, becoming a major revenue anchor, accounting for over 25% of total tax receipts in FY2024–25. Key to improving public finance efficiency, GST also reduces tax evasion via digital trails and real-time invoicing, and has boosted formalization in the Indian economy.

Through the National Monetisation Pipeline (NMP) and strategic disinvestment programs (like LIC’s IPO and Air India’s sale), the government seeks to unlock idle public assets and reduce fiscal burden. While progress has been mixed, with delays in PSU stake sales, asset monetization has provided alternative revenue sources without raising taxes—critical for sustaining capital expenditure momentum.

Recent Union Budgets have shifted emphasis from subsidies to infrastructure-led growth, with capital expenditure allocation hitting ₹11.11 lakh crore in FY25—a 16.9% increase over FY24. This public capex thrust is designed to crowd in private investment, support job creation, and spur GDP growth, while maintaining a glide path to fiscal consolidation. It reflects a conscious shift toward growth-oriented fiscal policy.

India’s public finance strategy includes targeted subsidies (e.g., DBT for food and LPG), state-specific fiscal transfers, and schemes like PM-KISAN and MNREGA, which provide income support and rural employment. The government balances fiscal inclusion with budgetary discipline, relying increasingly on Aadhaar-linked platforms and digitized payments to curb leakages and improve welfare efficiency.

Here are some final tips to enhance your understanding in the field of public finance:

Start by grasping the fundamental concepts such as taxation, government spending, budgeting, and public debt. A solid foundation helps in analyzing how government financial decisions impact the economy.

Governments frequently adjust fiscal policies to respond to economic changes. Keep an eye on new tax laws, spending programs, and budget announcements to understand their effects on public finance.

Efficient tax systems raise adequate revenue without discouraging economic activity. Advocating for fair, transparent taxation is key to improving the scope of public finance and ensuring sustainable government funding.

Public finance works best when governments are transparent about how funds are collected and spent. Encouraging open budgets and independent audits can reduce corruption and build public trust.

While borrowing can finance important projects, excessive public debt risks financial instability. Sound debt management involves balancing immediate needs with long-term repayment capacity.

Enrolling in a corporate law course is a smart move for anyone looking to succeed in today’s complex business and legal environment. With the right education, you will gain specialized knowledge in areas like mergers, compliance, and corporate governance. These skills are highly valued by top companies and law firms. As the corporate sector keeps changing, staying updated on legal developments and industry best practices is crucial for long-term success.

Remember, building a career in corporate law involves more than just classroom learning. Look for internships, take part in moot courts, and connect with industry experts to gain hands-on experience and practical insights. By investing in your education and continuously improving your skills, you will be ready to tackle new challenges, earn trust with clients, and make a meaningful impact in the corporate legal world in 2025 and beyond.

Adam Smith is known as the father of public finance. In his book The Wealth of Nations (1776), he established the basics of modern public finance and described the principles of taxation, government spending, and economic policy. His ideas continue to shape how governments collect money, spend on public services, and stabilize economies.

Tip: Focus on understanding Adam Smith’s key principles, such as “taxation fairness” and “efficient government spending.” This will make it easier to learn public finance concepts.

Studying public finance helps you understand how governments manage money, collect revenue, and allocate funds for public goods and services. It covers budgeting, taxation, debt management, and economic policies that impact everyday life. For instance, learning public finance helps you see why the Indian government directs funds toward infrastructure, healthcare, or education and how these choices affect citizens.

Tip: Focus on concepts like taxation, government spending, and fiscal policy; this makes public finance easier to grasp.

Finance is generally divided into three main types:

Personal Finance, which involves managing individual or household money, including savings, investments, and budgeting.

Corporate Finance, which focuses on managing a company’s finances, encompassing capital investment, funding, and risk management.

Public Finance, which deals with managing government revenue, spending, and debt to provide public goods and services.

For example, a Mumbai resident handles personal savings (personal finance), a company plans its budget for expansion (corporate finance), and the government allocates funds for healthcare and infrastructure (public finance).

Understanding each type and its purpose makes it much easier to grasp finance concepts.

Public finance is mainly managed by the government, including its finance ministry and related departments. They handle revenue collection, such as taxes, government spending, budgeting, and public debt. For example, in India, the Ministry of Finance prepares the annual budget, allocates funds for sectors like healthcare and infrastructure, and ensures fiscal stability.

Tip: Focus on understanding the role of the finance ministry, central and state governments, and fiscal policies. This makes public finance easier to understand.

Public finance has several branches, each focusing on different parts of managing government money.

Revenue Branch, deals with government income from taxes, fees, and other sources.

Expenditure Branch, focuses on government spending for public services and development projects.

Public Debt Branch, manages government borrowing and loan repayment.

Financial Administration Branch, handles budgeting, fiscal policies, and financial control.

For example, the Indian government collects taxes (revenue), funds healthcare and infrastructure (expenditure), manages loans (public debt), and prepares the annual budget (financial administration).

Understanding these branches helps in understanding how governments plan, spend, and regulate public funds effectively.

The rule of public finance includes the principles and guidelines that dictate how governments collect revenue, spend money, and handle public debt to keep the economy stable. Important rules are fairness in taxation, careful spending, efficient resource allocation, and accountability to the public.

For example, in India, the government fairly collects taxes, spends efficiently on public goods like roads and healthcare, and makes sure that borrowing does not negatively impact the economy.

Tip: Center your attention on understanding taxation, spending, and fiscal responsibility. This will make grasping public finance concepts much simpler.

Authored by, Gagandeep Khokhar

Career Guidance Expert

Gagandeep is a content writer and strategist focused on creating high-performing, SEO-driven content that bridges the gap between learners and institutions. He crafts compelling narratives across blogs, landing pages, and email campaigns to drive engagement and build trust.

Editor's Recommendations

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.